As I delve into the world of financial trading, I find myself increasingly captivated by the integration of artificial intelligence (AI) into this dynamic field. AI-assisted financial trading has emerged as a transformative force, reshaping how investors approach the markets. The ability of AI to analyze vast amounts of data at lightning speed offers a tantalizing glimpse into a future where trading decisions can be made with unprecedented precision.

I am intrigued by the potential benefits and challenges that come with this technological advancement, especially for retail investors like myself who may not have the same resources as institutional players. In recent years, the proliferation of AI technologies has made sophisticated trading strategies accessible to a broader audience. I have witnessed firsthand how algorithms can process market trends, news articles, and social media sentiment to generate insights that were once the domain of seasoned analysts.

This democratization of information is empowering for retail investors, allowing me to compete on a more level playing field. However, as I explore this new frontier, I am also aware of the complexities and risks that accompany AI-assisted trading. Understanding both the advantages and disadvantages is crucial for making informed decisions in this rapidly evolving landscape.

Key Takeaways

- AI-assisted financial trading uses advanced algorithms and machine learning to make investment decisions in the stock market.

- The pros of AI-assisted financial trading for retail investors include faster decision-making, reduced emotional bias, and access to sophisticated trading strategies.

- The cons of AI-assisted financial trading for retail investors include the potential for technical glitches, over-reliance on technology, and the lack of human intuition.

- Risk management is crucial in AI-assisted financial trading to mitigate potential losses and ensure the long-term success of investment strategies.

- Ethical and legal considerations in AI-assisted financial trading include issues of transparency, accountability, and the potential for market manipulation.

The Pros of AI-Assisted Financial Trading for Retail Investors

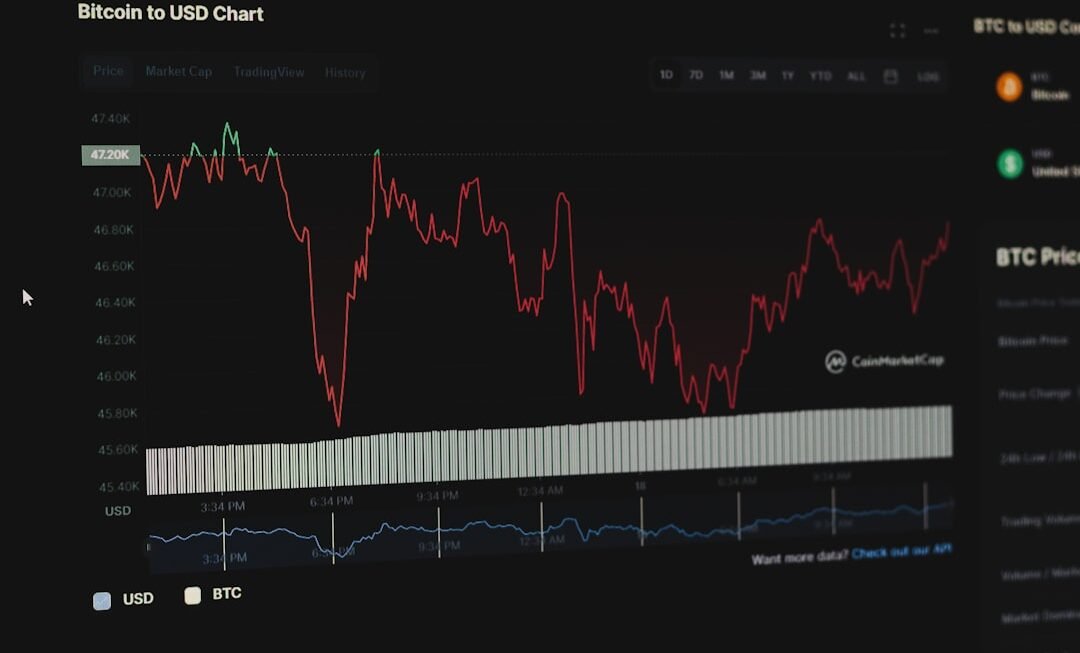

One of the most compelling advantages of AI-assisted financial trading is its ability to analyze data at an unprecedented scale. As a retail investor, I often find myself overwhelmed by the sheer volume of information available in the market. AI algorithms can sift through this data, identifying patterns and trends that might elude even the most experienced human traders.

This capability allows me to make more informed decisions based on comprehensive analyses rather than relying solely on intuition or limited research. Moreover, AI can enhance my trading efficiency by automating various processes. For instance, I can set up algorithms to execute trades based on predefined criteria, freeing me from the need to monitor the markets constantly.

This automation not only saves time but also helps eliminate emotional biases that can cloud judgment during trading. I appreciate how AI can help me stick to my trading plan, reducing the likelihood of impulsive decisions driven by fear or greed. In this way, AI becomes a valuable ally in my quest for financial success.

The Cons of AI-Assisted Financial Trading for Retail Investors

Despite the numerous benefits, I must also acknowledge the potential downsides of relying on AI-assisted financial trading. One significant concern is the risk of over-reliance on technology. While algorithms can process data efficiently, they are not infallible.

I have seen instances where market conditions change rapidly, rendering previously effective models obsolete. This unpredictability can lead to significant losses if I place too much trust in automated systems without understanding their limitations. Additionally, there is the issue of transparency.

Many AI algorithms operate as “black boxes,” meaning that their decision-making processes are not easily understood by users like myself. This lack of transparency can be disconcerting, as I may find it challenging to assess the rationale behind specific trading recommendations. Without a clear understanding of how an algorithm arrives at its conclusions, I risk making decisions based on outputs that I cannot fully comprehend.

This uncertainty can create anxiety and hesitation in my trading strategy.

Risk Management and AI-Assisted Financial Trading

Effective risk management is a cornerstone of successful trading, and AI-assisted financial trading offers innovative tools to help me navigate this critical aspect. One way AI enhances risk management is through predictive analytics. By analyzing historical data and market trends, AI algorithms can identify potential risks and suggest strategies to mitigate them.

This proactive approach allows me to make informed decisions about position sizing and stop-loss orders, ultimately protecting my capital. However, I must remain vigilant in my risk management practices. While AI can provide valuable insights, it is essential for me to maintain a comprehensive understanding of my risk tolerance and investment goals.

Relying solely on AI-generated recommendations without considering my unique circumstances could lead to misaligned strategies. Therefore, I view AI as a complementary tool rather than a replacement for my judgment in managing risk effectively.

Ethical and Legal Considerations of AI-Assisted Financial Trading

As I explore the realm of AI-assisted financial trading, I cannot ignore the ethical and legal implications that accompany this technology. One pressing concern is the potential for market manipulation through algorithmic trading strategies. The speed at which AI operates can create opportunities for unethical practices, such as “quote stuffing” or “flash trading,” which can distort market dynamics and disadvantage retail investors like myself.

Moreover, there are questions surrounding data privacy and security. The algorithms that power AI-assisted trading rely on vast amounts of data, including personal information and trading history. As a retail investor, I am acutely aware of the importance of safeguarding my data from potential breaches or misuse.

Regulatory bodies are beginning to address these concerns, but it is crucial for me to stay informed about the evolving legal landscape surrounding AI in finance.

The Role of Human Judgment in AI-Assisted Financial Trading

While AI brings remarkable capabilities to financial trading, I firmly believe that human judgment remains an indispensable component of the process. Algorithms excel at processing data and identifying patterns, but they lack the nuanced understanding of market sentiment and geopolitical factors that can influence price movements. As a retail investor, I recognize that my intuition and experience play a vital role in interpreting market signals that may not be captured by algorithms.

Furthermore, there are times when market conditions defy historical patterns or established models. In such instances, my ability to adapt and make decisions based on real-time information becomes crucial. I appreciate how combining human judgment with AI insights can lead to more robust trading strategies.

By leveraging both my analytical skills and the power of technology, I can navigate the complexities of the market with greater confidence.

The Future of AI-Assisted Financial Trading for Retail Investors

Looking ahead, I am excited about the future of AI-assisted financial trading for retail investors like myself. As technology continues to advance, I anticipate even more sophisticated algorithms that can adapt to changing market conditions in real time. The integration of machine learning techniques will likely enhance predictive capabilities, allowing me to make more accurate forecasts about price movements.

Moreover, I foresee a growing emphasis on user-friendly interfaces that empower retail investors to harness the power of AI without requiring extensive technical knowledge. As platforms become more accessible, I believe that more individuals will embrace AI-assisted trading as a viable option for wealth-building. However, it will be essential for me to remain vigilant about ethical considerations and ensure that I am using these tools responsibly.

Making Informed Decisions about AI-Assisted Financial Trading

In conclusion, my journey into the world of AI-assisted financial trading has been both enlightening and challenging. While the advantages are compelling—ranging from enhanced data analysis to improved efficiency—I must remain mindful of the potential pitfalls associated with over-reliance on technology and ethical concerns surrounding its use. As a retail investor, it is crucial for me to strike a balance between leveraging AI’s capabilities and exercising my judgment.

As I navigate this evolving landscape, I am committed to staying informed about developments in AI technology and its implications for financial trading. By making informed decisions and maintaining a critical perspective on both the benefits and risks, I can harness the power of AI while safeguarding my interests as an investor. Ultimately, embracing this technology with caution will enable me to thrive in an increasingly complex financial environment.