In recent years, I have witnessed a remarkable transformation in the landscape of Forex trading, primarily driven by the rise of automated trading systems. These systems, often referred to as algorithmic trading or trading bots, have revolutionized the way traders engage with the foreign exchange market. The increasing accessibility of technology and the proliferation of high-speed internet have made it possible for both novice and experienced traders to leverage sophisticated algorithms that can execute trades at lightning speed.

As I delve deeper into this phenomenon, I realize that the shift towards automation is not merely a trend; it represents a fundamental change in how trading is approached. The surge in automated trading systems can be attributed to several factors. First and foremost, the demand for efficiency and precision in trading has never been higher.

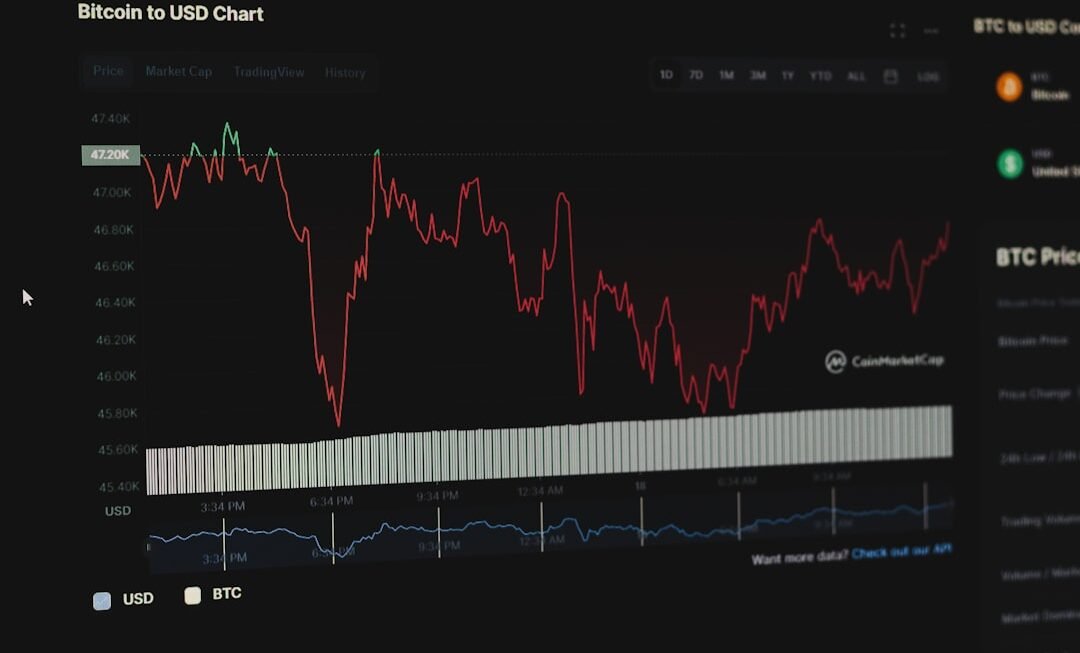

I have observed that traders are increasingly seeking ways to eliminate human error and emotional decision-making from their strategies. Automated systems can analyze vast amounts of data in real-time, allowing them to identify patterns and execute trades based on predefined criteria. This capability has made them particularly appealing in the fast-paced world of Forex, where even a fraction of a second can make a significant difference in profitability.

As I reflect on my own experiences, I recognize that the allure of automation lies not only in its speed but also in its ability to operate around the clock, capitalizing on market opportunities even when I am not actively monitoring my trades.

Key Takeaways

- Automated trading systems have become increasingly popular in forex markets due to their ability to execute trades without human intervention.

- These systems work by using pre-programmed rules and algorithms to analyze market conditions and execute trades automatically.

- The benefits of using automated trading systems include the ability to trade 24/7, remove emotional decision-making, and backtest strategies for improved performance.

- Potential risks of automated trading systems include system failures, over-optimization, and the need for constant monitoring to ensure proper functioning.

- When choosing the right automated trading system, it’s important to consider factors such as strategy, risk management, and transparency of the system’s performance.

How Automated Trading Systems Work

The Core of Automated Trading

Automated trading systems rely on algorithms, which are sets of rules and instructions that dictate when to buy or sell a currency pair. These algorithms can be incredibly complex, incorporating various technical indicators, historical data analysis, and even machine learning techniques.

The Power of Automation

The beauty of automation lies in its ability to process information far beyond human capabilities, allowing for more informed trading decisions. One of the most fascinating aspects of automated trading systems is the concept of backtesting, which involves running the algorithm against historical market data to evaluate its performance under different market conditions.

Accessibility and Confidence

By simulating trades based on past data, traders can gain insights into how the system might perform in real-time scenarios, providing a level of confidence before committing real capital. Many platforms offer user-friendly interfaces that allow traders to customize their algorithms without needing extensive programming knowledge, making automated trading accessible to countless individuals.

The Benefits of Using Automated Trading Systems

The advantages of utilizing automated trading systems are numerous and compelling. One of the most significant benefits I have experienced is the elimination of emotional trading. In my early days as a trader, I often found myself making impulsive decisions driven by fear or greed.

However, with an automated system in place, trades are executed based on logic and predefined parameters rather than my fluctuating emotions. This shift has not only improved my overall trading performance but has also provided me with a sense of peace knowing that my strategy is being executed consistently. Another benefit that stands out to me is the ability to diversify my trading portfolio effortlessly.

Automated systems can manage multiple currency pairs simultaneously, allowing me to spread risk across various markets without requiring constant attention. This diversification has been crucial in enhancing my overall returns while minimizing potential losses. Furthermore, the time-saving aspect of automation cannot be overstated.

With an automated system handling trade execution and monitoring, I have more time to focus on research and strategy development rather than being glued to my screen for hours on end.

The Potential Risks of Automated Trading Systems

Despite the numerous advantages, I have come to understand that automated trading systems are not without their risks. One of the primary concerns is the reliance on technology. While algorithms can process data quickly and efficiently, they are not infallible.

Technical glitches or connectivity issues can lead to missed opportunities or unintended trades. I have learned the importance of having contingency plans in place to mitigate these risks, such as setting up alerts or using backup systems. Another risk that I have encountered is the potential for over-optimization.

In my quest for the perfect trading strategy, I found myself tweaking my algorithms excessively based on historical data. While this may seem beneficial at first glance, it can lead to a phenomenon known as “curve fitting,” where a system performs exceptionally well on past data but fails to adapt to changing market conditions. This realization has taught me the importance of maintaining a balance between optimization and adaptability, ensuring that my automated system remains robust in various market environments.

Choosing the Right Automated Trading System for You

Selecting the right automated trading system has been one of the most critical decisions in my trading journey. With countless options available in the market, it can be overwhelming to determine which system aligns best with my trading goals and risk tolerance. To navigate this process effectively, I have learned to prioritize certain factors when evaluating different systems.

First and foremost, I consider the system’s track record and performance history. Analyzing past results provides valuable insights into how well the system has performed under various market conditions. Additionally, I pay close attention to user reviews and testimonials from other traders who have utilized the system.

Their experiences can offer a wealth of information regarding reliability and effectiveness. Furthermore, I ensure that the system is compatible with my preferred trading platform and offers sufficient customization options to tailor it to my specific needs.

The Future of Automated Trading Systems in Forex Markets

Advancements in Technology

As I look ahead, I am excited about the future of automated trading systems in Forex markets. The rapid advancements in technology, particularly in artificial intelligence and machine learning, are poised to further enhance the capabilities of these systems.

Real-Time Adaptation

I envision a future where algorithms can not only analyze historical data but also adapt in real-time to changing market dynamics, making them even more effective at identifying profitable opportunities.

Human-Machine Collaboration

Moreover, as more traders embrace automation, I anticipate an increase in collaboration between human traders and automated systems. Rather than viewing automation as a replacement for human intuition and expertise, I believe that successful traders will learn to leverage these tools as valuable partners in their decision-making processes. This synergy between human insight and machine efficiency could lead to unprecedented levels of success in Forex trading.

Tips for Maximizing the Effectiveness of Automated Trading Systems

To truly harness the power of automated trading systems, I have discovered several tips that can significantly enhance their effectiveness. First and foremost, continuous monitoring is essential. While automation allows for hands-off trading, it is crucial for me to regularly review performance metrics and make necessary adjustments based on changing market conditions.

This proactive approach ensures that my system remains aligned with my trading goals. Additionally, I have found that maintaining realistic expectations is vital. While automated systems can provide impressive results, they are not a guaranteed path to riches.

Understanding that losses are a part of trading has helped me maintain a balanced perspective and avoid making impulsive decisions during drawdowns. Lastly, staying informed about market trends and economic events is crucial for optimizing my automated strategies. By keeping abreast of relevant news and developments, I can make informed adjustments to my algorithms when necessary.

The Role of Regulation in Automated Trading Systems

As automated trading systems continue to gain traction in Forex markets, I recognize the importance of regulation in ensuring fair practices and protecting traders like myself from potential pitfalls. Regulatory bodies play a crucial role in establishing guidelines that govern algorithmic trading practices, promoting transparency and accountability within the industry. I have come to appreciate that regulations can help mitigate risks associated with automated trading systems by enforcing standards for system performance and risk management practices.

Additionally, regulatory oversight can foster trust among traders by ensuring that brokers offering automated solutions adhere to ethical practices. As I navigate this evolving landscape, I remain vigilant about choosing regulated brokers and platforms that prioritize compliance with industry standards. In conclusion, my journey into the world of automated trading systems has been both enlightening and transformative.

From understanding their mechanics to recognizing their benefits and risks, I have gained valuable insights that have shaped my approach to Forex trading. As technology continues to evolve, I am excited about the possibilities that lie ahead and remain committed to leveraging automation as a powerful tool in my trading arsenal while navigating its complexities with caution and diligence.