As I delve into the world of cryptocurrency, one of the first concepts I encounter is that of cryptocurrency exchanges. These platforms serve as the digital marketplaces where I can buy, sell, and trade various cryptocurrencies. Essentially, they act as intermediaries between buyers and sellers, facilitating transactions in a secure environment.

The significance of these exchanges cannot be overstated; they are the backbone of the cryptocurrency ecosystem, enabling liquidity and price discovery for digital assets. There are two primary types of exchanges that I can choose from: centralized and decentralized. Centralized exchanges, like Coinbase and Binance, are operated by companies that manage the platform and hold users’ funds.

This structure often provides a user-friendly experience, with features such as customer support and advanced trading tools. On the other hand, decentralized exchanges (DEXs) like Uniswap and SushiSwap operate without a central authority, allowing me to trade directly from my wallet. While DEXs offer greater privacy and control over my assets, they may come with a steeper learning curve and less user support.

Understanding these differences is crucial as I navigate my entry into cryptocurrency trading.

Key Takeaways

- Cryptocurrency exchanges are online platforms where you can buy, sell, and trade digital currencies.

- When choosing the right exchange for you, consider factors such as security, fees, available cryptocurrencies, and user interface.

- Setting up your exchange account involves creating an account, verifying your identity, and securing your account with two-factor authentication.

- Making your first trade on a cryptocurrency exchange involves placing a buy or sell order for a specific cryptocurrency at the desired price.

- Understanding fees and security measures is crucial for successful trading, as different exchanges have varying fee structures and security protocols.

Choosing the Right Exchange for You

When it comes to selecting the right exchange for my trading needs, I realize that several factors come into play. First and foremost, I consider the range of cryptocurrencies available on the platform. Some exchanges offer a limited selection, while others boast hundreds of different coins and tokens.

If I have specific cryptocurrencies in mind that I want to trade, it’s essential to ensure that the exchange supports them. Another critical aspect I evaluate is the user interface and overall experience. A well-designed platform can make my trading journey much smoother, especially if I am new to the space.

I appreciate exchanges that provide intuitive navigation, clear charts, and educational resources to help me understand market trends. Additionally, I pay attention to the exchange’s reputation and security measures. Reading user reviews and checking for any past security breaches can give me insight into how trustworthy an exchange is.

Ultimately, finding an exchange that aligns with my trading goals and comfort level is key to my success in this dynamic market.

Setting Up Your Exchange Account

Once I’ve chosen an exchange that fits my needs, the next step is setting up my account. This process typically begins with providing my email address and creating a secure password. However, due to regulatory requirements, most exchanges also require me to complete a Know Your Customer (KYC) verification process.

This involves submitting personal information such as my name, address, and identification documents. While this step may seem tedious, it’s essential for ensuring compliance with financial regulations and enhancing security. After successfully verifying my identity, I can proceed to secure my account further by enabling two-factor authentication (2FA).

This additional layer of security requires me to provide a second form of identification—usually a code sent to my mobile device—whenever I log in or make significant changes to my account. Taking these precautions helps protect my assets from potential threats and unauthorized access. With my account set up and secured, I am now ready to explore the exciting world of cryptocurrency trading.

Making Your First Trade

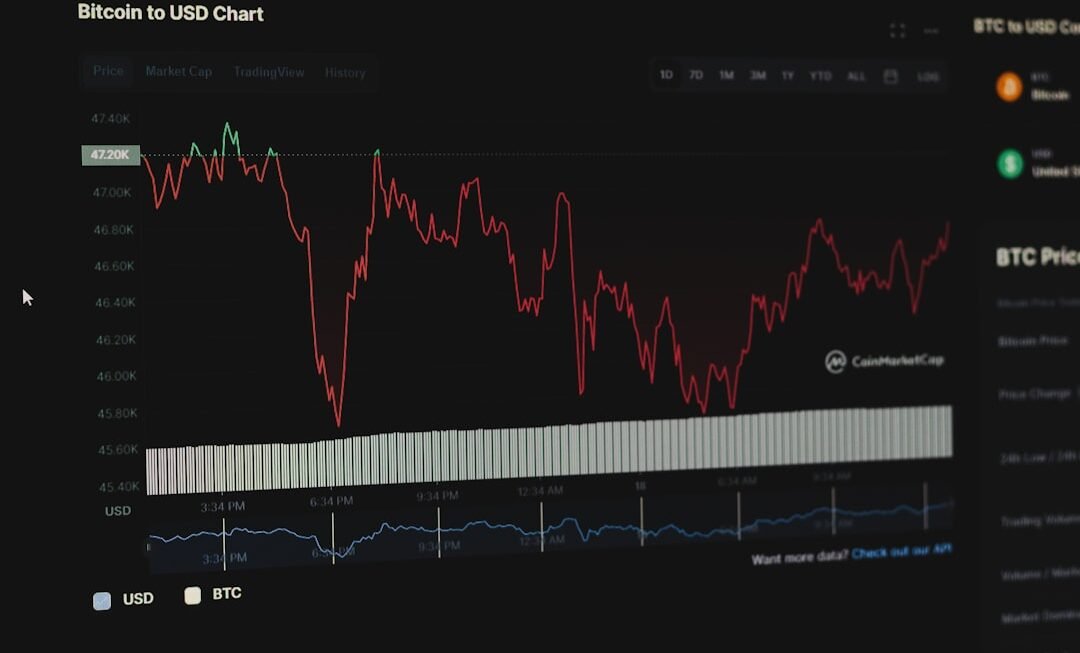

With my account fully established and funded, I feel a mix of excitement and nervousness as I prepare to make my first trade. The process typically begins with selecting the cryptocurrency pair I wish to trade. For instance, if I want to buy Bitcoin using Ethereum, I would navigate to the trading section of the exchange and select the BTC/ETH pair.

Understanding how to read price charts and market orders is crucial at this stage; I familiarize myself with concepts like limit orders and market orders to ensure I make informed decisions. As I place my first order, I take a moment to reflect on my strategy. Am I looking for a quick profit or planning to hold onto my investment for the long term?

This decision will influence how I approach my trade. After confirming my order details, I hit the “buy” button with a sense of anticipation. Watching the transaction process unfold in real-time is exhilarating; it’s a tangible step into the world of cryptocurrency that I’ve been eager to explore.

Understanding Fees and Security Measures

As I continue my trading journey, it becomes increasingly important for me to understand the fees associated with using an exchange. Most platforms charge transaction fees for trades, which can vary significantly depending on the exchange and the type of order placed. Some exchanges offer tiered fee structures based on trading volume, while others may charge flat fees regardless of activity levels.

Being aware of these costs helps me make more informed decisions about when and how much to trade. In addition to transaction fees, I also consider withdrawal fees when transferring my assets off the exchange. These fees can add up quickly if I’m not careful, so it’s wise for me to factor them into my overall trading strategy.

Furthermore, security measures are paramount in this space; I take time to research how different exchanges protect user funds. Features like cold storage for assets, regular security audits, and insurance policies against hacks are indicators of a reliable platform. By prioritizing both cost-effectiveness and security, I can create a more sustainable trading experience.

Tips for Successful Trading

As I immerse myself deeper into cryptocurrency trading, I’ve learned that success often hinges on a combination of strategy, discipline, and continuous learning. One of the most valuable tips I’ve picked up is to establish a clear trading plan before entering any position. This plan should outline my goals, risk tolerance, and exit strategies.

By having a well-defined approach, I’m less likely to make impulsive decisions driven by emotions or market hype. Another crucial aspect of successful trading is staying informed about market trends and developments. The cryptocurrency landscape is constantly evolving; new projects emerge daily while existing ones undergo significant changes.

By following reputable news sources and engaging with online communities, I can gain insights that may influence my trading decisions. Additionally, practicing risk management techniques—such as setting stop-loss orders—can help protect my investments from unexpected market fluctuations.

Keeping Up with Market Trends and News

In the fast-paced world of cryptocurrency, staying updated on market trends is essential for making informed trading decisions. I’ve found that subscribing to newsletters from reputable sources or following influential figures on social media can provide valuable insights into emerging trends or potential market shifts. Engaging with online forums or communities also allows me to share knowledge with fellow traders and learn from their experiences.

Moreover, understanding macroeconomic factors that influence cryptocurrency prices is vital for my trading strategy. Events such as regulatory changes, technological advancements, or shifts in investor sentiment can have profound effects on market dynamics. By keeping an eye on these developments, I can better anticipate potential price movements and adjust my trading approach accordingly.

Staying Safe in the Cryptocurrency World

As I navigate through the exhilarating yet volatile world of cryptocurrency trading, prioritizing safety remains at the forefront of my mind. One of the most effective ways I’ve found to protect myself is by using hardware wallets for long-term storage of my assets. Unlike exchanges that are susceptible to hacks, hardware wallets keep my private keys offline, significantly reducing the risk of theft.

Additionally, being vigilant about phishing attempts is crucial in this digital landscape. I’ve learned to double-check URLs before entering sensitive information and avoid clicking on suspicious links in emails or messages claiming to be from exchanges or wallet providers. By adopting these safety measures and remaining cautious about sharing personal information online, I can enjoy a more secure trading experience while exploring the vast opportunities within the cryptocurrency market.

In conclusion, embarking on a journey into cryptocurrency trading has been both thrilling and educational for me. By understanding exchanges, choosing the right platform, setting up accounts securely, making informed trades, managing fees effectively, staying updated on trends, and prioritizing safety measures, I’ve laid a solid foundation for success in this dynamic environment. As I continue to learn and grow as a trader, I’m excited about what lies ahead in this ever-evolving digital landscape.