As I delve into the world of options trading, I find that algorithms play a pivotal role in shaping the landscape of financial markets. Options trading algorithms are essentially sets of rules or instructions that automate the process of buying and selling options contracts. These algorithms analyze vast amounts of market data, identify patterns, and execute trades at speeds that are impossible for human traders to match.

By leveraging advanced mathematical models and statistical techniques, these algorithms can make informed decisions based on real-time market conditions. The complexity of options trading algorithms can be daunting, yet their fundamental purpose is straightforward: to enhance trading efficiency and profitability. I have come to appreciate how these algorithms can process information from various sources, including historical price data, market sentiment, and economic indicators.

This multifaceted approach allows them to adapt to changing market dynamics, making them invaluable tools for traders seeking to capitalize on opportunities in the options market.

Key Takeaways

- Options trading algorithms are computer programs designed to execute trading strategies in the options market, using mathematical models and historical data to make decisions.

- Options trading algorithms play a crucial role in volatile markets by providing traders with the ability to react quickly to changing market conditions and execute complex trading strategies.

- Using options trading algorithms can offer advantages such as increased speed of execution, reduced emotional bias, and the ability to backtest and optimize trading strategies.

- Common types of options trading algorithms include delta-neutral strategies, volatility arbitrage, and market-making algorithms.

- Implementing options trading algorithms in decision-making requires careful consideration of factors such as market conditions, risk tolerance, and the specific goals of the trader.

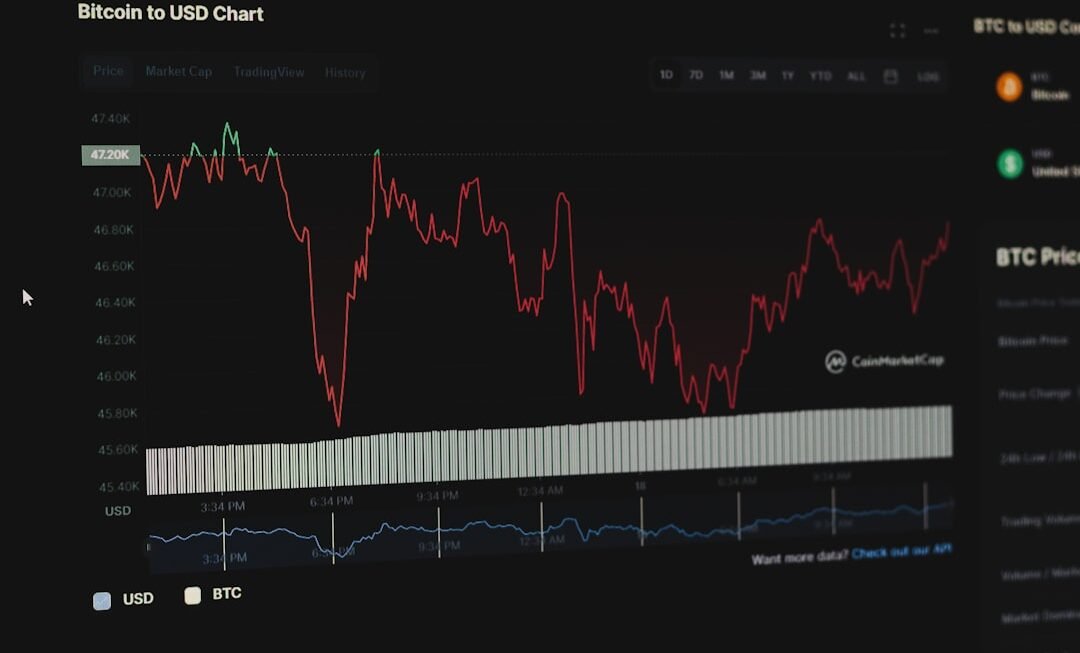

The Role of Options Trading Algorithms in Volatile Markets

Swift Reaction to Market Changes

During periods of heightened volatility, these algorithms can react swiftly to market changes, executing trades in milliseconds. This speed is crucial because it allows traders to take advantage of fleeting opportunities that may arise due to sudden shifts in market sentiment or economic news.

Risk Mitigation Strategies

Moreover, options trading algorithms can help mitigate risks associated with volatility. By employing sophisticated risk management techniques, these algorithms can adjust positions dynamically based on real-time data. For instance, algorithms can implement hedging strategies to protect against adverse price movements, ensuring that my portfolio remains resilient even in turbulent market conditions.

Navigating Complex Markets with Confidence

This adaptability is a significant advantage, as it allows me to navigate the complexities of volatile markets with greater confidence.

Advantages of Using Options Trading Algorithms

One of the most compelling advantages of using options trading algorithms is their ability to eliminate emotional biases from trading decisions. As a trader, I know how emotions like fear and greed can cloud judgment and lead to poor decision-making. However, algorithms operate based on data and predefined criteria, ensuring that trades are executed based on logic rather than emotion.

This objectivity can significantly enhance my trading performance over time. Additionally, options trading algorithms can analyze vast datasets far beyond what I could manage manually. They can identify trends and correlations that may not be immediately apparent to human traders.

This analytical prowess enables me to make more informed decisions and increases the likelihood of successful trades. Furthermore, the automation of trade execution allows me to focus on strategy development and market analysis rather than getting bogged down in the minutiae of individual trades.

Common Types of Options Trading Algorithms

As I explore the various types of options trading algorithms, I find that they can be broadly categorized into several distinct strategies. One common type is the market-making algorithm, which aims to profit from the bid-ask spread by continuously quoting prices for options contracts. These algorithms provide liquidity to the market, ensuring that traders can enter and exit positions with ease.

Another prevalent type is the arbitrage algorithm, which seeks to exploit price discrepancies between related assets or markets. For instance, I have seen how these algorithms can identify situations where an option is mispriced relative to its underlying asset or other derivatives. By executing simultaneous buy and sell orders, arbitrage algorithms can lock in profits while minimizing risk.

Additionally, trend-following algorithms are designed to capitalize on established market trends by entering positions in the direction of the trend and exiting when signs of reversal appear.

Implementing Options Trading Algorithms in Decision-Making

Integrating options trading algorithms into my decision-making process has been a transformative experience. To begin with, I must first define my trading objectives and risk tolerance clearly. This foundational step allows me to select or develop algorithms that align with my specific goals.

Once I have established my parameters, I can begin testing various algorithms using historical data to evaluate their performance under different market conditions. Backtesting is a crucial aspect of this implementation process. By simulating trades based on historical data, I can gain insights into how an algorithm would have performed in the past.

This analysis helps me refine my strategies and make necessary adjustments before deploying them in live markets. Additionally, I find it essential to continuously monitor the performance of my chosen algorithms once they are live. Market conditions are ever-changing, and what works today may not be effective tomorrow.

Regularly reviewing and optimizing my algorithms ensures that I remain competitive in the fast-paced world of options trading.

Risks and Challenges of Using Options Trading Algorithms

Using options trading algorithms can be a powerful tool for investors, but it’s not without its risks and challenges.

Technical Risks and Glitches

One significant concern is the potential for technical failures or glitches in the algorithm itself. Even minor coding errors can lead to substantial financial losses if not addressed promptly.

Reliance on Historical Data

Another challenge lies in the reliance on historical data for algorithm development. While past performance can provide valuable insights, it does not guarantee future results.

Adapting to Changing Market Conditions

Market conditions can change rapidly due to unforeseen events or shifts in investor sentiment, rendering previously successful strategies ineffective. To mitigate this risk, it is essential to remain adaptable and willing to adjust algorithms as new information becomes available.

Best Practices for Utilizing Options Trading Algorithms

To maximize the effectiveness of options trading algorithms, I have adopted several best practices that guide my approach. First and foremost, I prioritize continuous education and staying informed about market trends and developments. The financial landscape is constantly evolving, and being aware of macroeconomic factors or regulatory changes can significantly impact my trading strategies.

Additionally, I emphasize diversification in my algorithmic trading approach. By employing multiple algorithms with different strategies and risk profiles, I can spread my risk across various positions and reduce the impact of any single algorithm’s underperformance. This diversification strategy has proven beneficial in maintaining a balanced portfolio while navigating the complexities of options trading.

The Future of Options Trading Algorithms in Volatile Markets

Looking ahead, I am excited about the future of options trading algorithms in volatile markets. As technology continues to advance, I anticipate that these algorithms will become even more sophisticated, incorporating artificial intelligence and machine learning capabilities. This evolution will enable them to analyze vast datasets more effectively and adapt to changing market conditions with greater agility.

Moreover, as more traders embrace algorithmic trading, I foresee increased competition among algorithms themselves. This competition could lead to innovations in trading strategies and risk management techniques that benefit all participants in the market. Ultimately, I believe that options trading algorithms will play an increasingly central role in shaping the future of financial markets, providing traders like myself with powerful tools to navigate volatility and seize opportunities as they arise.

In conclusion, my journey into options trading has revealed the profound impact that algorithms have on this dynamic field. From enhancing decision-making processes to mitigating risks associated with volatility, these tools have transformed how I approach trading. As I continue to explore this fascinating domain, I remain committed to leveraging the power of options trading algorithms while staying vigilant about their inherent challenges and risks.

The future holds great promise for those willing to embrace innovation and adapt to an ever-changing landscape.