In recent years, social media has emerged as a powerful tool in the world of Forex and cryptocurrency trading. As I navigate through the complexities of these financial markets, I find that platforms like Twitter, Facebook, and Reddit have become essential resources for traders seeking real-time information and insights. The rapid dissemination of news and opinions on social media can significantly influence market movements, making it imperative for me to stay connected and engaged with these platforms.

The integration of social media into trading strategies has transformed the way I approach market analysis, allowing me to tap into a wealth of information that was previously inaccessible. The rise of social media has democratized access to trading knowledge, enabling both novice and experienced traders to share their insights and strategies. I often find myself scrolling through various feeds, absorbing the latest trends, tips, and analyses shared by fellow traders.

This shift has not only changed how I gather information but has also fostered a sense of community among traders. As I engage with others in discussions about market trends and potential trades, I realize that social media has become an integral part of my trading journey, shaping my decisions and strategies in ways I never anticipated.

Key Takeaways

- Social media has become an integral part of forex and crypto trading, providing a platform for market analysis, research, and trading strategies.

- Social media plays a crucial role in market analysis and research, offering real-time news, expert insights, and community discussions that can impact trading decisions.

- The influence of social media on trading psychology and sentiment is significant, as it can create FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) among traders, affecting market trends.

- Social media can impact market volatility and trends through viral news, rumors, and coordinated trading activities, leading to sudden price fluctuations and market movements.

- Traders utilize various social media platforms for trading strategies, including Twitter, Reddit, and trading forums, to share tips, analysis, and signals, but it comes with risks and challenges.

The Role of Social Media in Market Analysis and Research

When it comes to market analysis, social media serves as a treasure trove of information. I often rely on platforms like Twitter to follow industry experts and analysts who share their insights on market trends and price movements. The immediacy of social media allows me to receive updates in real-time, which is crucial in the fast-paced world of Forex and crypto trading.

By following key influencers and analysts, I can quickly gauge market sentiment and make informed decisions based on the latest developments. Moreover, social media facilitates a collaborative approach to research. I frequently participate in discussions on forums and groups dedicated to trading, where I can exchange ideas with other traders.

This collaborative environment enhances my understanding of market dynamics and helps me identify potential trading opportunities that I might have overlooked. The ability to crowdsource information from a diverse group of traders enriches my analysis and allows me to approach the market from multiple perspectives.

Influence of Social Media on Trading Psychology and Sentiment

The psychological aspect of trading cannot be underestimated, and social media plays a significant role in shaping my trading mindset. As I engage with various communities online, I often find myself influenced by the prevailing sentiment surrounding specific assets. For instance, during periods of heightened excitement or fear, I notice that my own emotions can be swayed by the collective sentiment expressed on social media platforms.

This phenomenon highlights the importance of being aware of how external influences can impact my decision-making process. Additionally, social media can amplify both positive and negative sentiments, leading to herd behavior among traders. I have observed instances where a single tweet or post can trigger a wave of buying or selling activity, causing significant price fluctuations.

This volatility can be both an opportunity and a risk for me as a trader. While it presents the chance to capitalize on rapid price movements, it also underscores the need for me to remain grounded in my analysis and not succumb to the emotional highs and lows that social media can evoke.

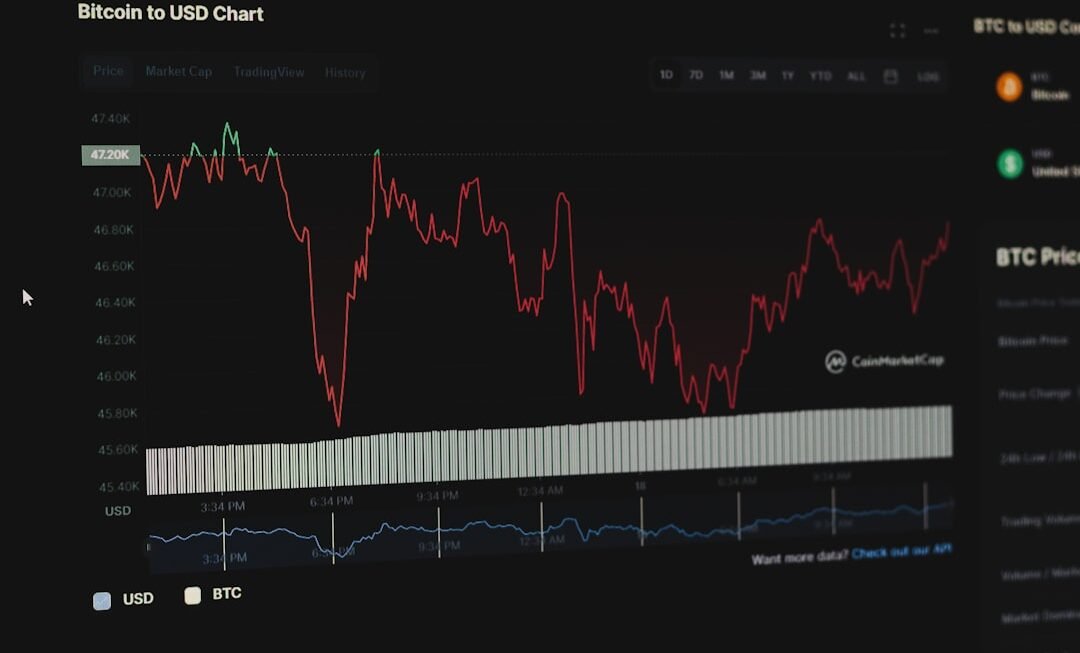

The Impact of Social Media on Market Volatility and Trends

The relationship between social media activity and market volatility is undeniable. As I monitor social media trends, I often notice how certain topics or events can lead to sudden spikes in trading volume and price fluctuations. For example, when a major news event breaks or a prominent figure makes a statement about a cryptocurrency, the resulting chatter on social media can create a ripple effect throughout the market.

This heightened activity can lead to increased volatility, which presents both opportunities and challenges for me as a trader. Furthermore, social media has the power to shape long-term trends in the Forex and crypto markets. By analyzing discussions and sentiment over time, I can identify emerging trends that may not yet be reflected in traditional market analysis.

For instance, if I notice a growing number of traders expressing interest in a particular cryptocurrency or currency pair, it may signal an impending shift in market dynamics. This insight allows me to position myself strategically ahead of potential price movements, enhancing my overall trading strategy.

Social Media Platforms and Trading Strategies

Different social media platforms offer unique advantages for traders like me, each catering to various aspects of trading strategies. Twitter, for instance, is known for its fast-paced nature, making it an ideal platform for real-time updates and breaking news. I often use Twitter to follow influential traders and analysts who provide timely insights that can inform my trading decisions.

The brevity of tweets encourages concise communication, allowing me to quickly digest information without getting bogged down by lengthy articles. On the other hand, platforms like Reddit provide a more in-depth discussion environment where traders can engage in longer conversations about specific assets or strategies. Subreddits dedicated to Forex and cryptocurrency trading serve as valuable resources for sharing experiences, strategies, and analyses.

I find that participating in these discussions not only enhances my knowledge but also allows me to connect with like-minded individuals who share my passion for trading. By leveraging the strengths of different platforms, I can create a well-rounded approach to my trading strategy that incorporates real-time updates as well as deeper analyses.

Risks and Challenges of Using Social Media in Trading

While social media offers numerous benefits for traders, it also presents several risks and challenges that I must navigate carefully. One significant concern is the prevalence of misinformation and unverified claims circulating on these platforms. As I sift through various posts and tweets, I am often confronted with conflicting opinions and dubious advice that can lead me astray if I’m not discerning.

It is crucial for me to verify information from credible sources before making any trading decisions based on social media content. Another challenge is the potential for over-reliance on social media sentiment. While it is essential to stay informed about market trends and opinions, I must also remember that not all voices are equally informed or experienced.

The fear of missing out (FOMO) can be particularly potent when I see others making profitable trades based on social media discussions. To mitigate this risk, I strive to maintain a balanced approach by combining insights from social media with my own research and analysis.

Regulation and Compliance in Social Media Trading

As social media continues to play an increasingly prominent role in Forex and crypto trading, regulatory bodies are beginning to take notice. The potential for market manipulation through coordinated social media campaigns raises concerns about fairness and transparency in trading practices. As a trader, I recognize the importance of adhering to regulations that govern trading activities, especially when engaging with content shared on social media platforms.

Regulatory compliance is essential not only for protecting myself but also for maintaining the integrity of the markets. As authorities implement guidelines regarding advertising, endorsements, and information dissemination on social media, I must stay informed about these developments to ensure that my trading practices align with legal requirements. By being proactive about compliance, I can contribute to a more transparent trading environment while safeguarding my own interests.

The Future of Social Media in Forex and Crypto Trading

Looking ahead, I believe that the role of social media in Forex and crypto trading will continue to evolve. As technology advances and new platforms emerge, the ways in which traders interact with each other and access information will likely change dramatically. I anticipate that innovations such as artificial intelligence and machine learning will further enhance the ability to analyze sentiment from social media data, providing even more valuable insights for traders like me.

Moreover, as regulatory frameworks become more established, I expect that social media will become an even more integral part of the trading landscape. With increased scrutiny on misinformation and market manipulation, responsible use of social media will be paramount for traders seeking to navigate these markets successfully. As I embrace the future of trading, I remain committed to leveraging the power of social media while being mindful of its challenges and responsibilities.

In conclusion, social media has undeniably transformed the way I approach Forex and crypto trading. From enhancing my market analysis to influencing my trading psychology, its impact is profound. While there are risks involved, the benefits far outweigh them when approached with caution and discernment.

As I continue my journey as a trader, I look forward to exploring new opportunities presented by social media while remaining vigilant about its challenges and implications for the future of trading.