As I delve into the world of Forex trading, I find myself increasingly captivated by the role of machine learning in this dynamic field. The foreign exchange market, known for its volatility and complexity, presents a unique set of challenges for traders. Traditional methods of analysis often fall short in capturing the rapid fluctuations and intricate patterns that characterize currency movements.

This is where machine learning comes into play, offering innovative solutions that can enhance trading strategies and improve decision-making processes. Machine learning, a subset of artificial intelligence, involves the development of algorithms that enable computers to learn from and make predictions based on data. In the context of Forex trading, these algorithms can analyze vast amounts of historical and real-time data to identify trends, patterns, and anomalies that may not be immediately apparent to human traders.

As I explore this intersection of technology and finance, I am eager to understand how machine learning can transform the way I approach trading in the Forex market.

Key Takeaways

- Machine learning is a powerful tool for analyzing and predicting forex market trends, and it has the potential to revolutionize trading strategies.

- Understanding market trends and patterns is essential for successful forex trading, and machine learning can help identify and capitalize on these trends.

- Historical data is crucial for training machine learning models in forex trading, as it provides valuable insights into past market behavior.

- Predictive modeling and algorithmic trading using machine learning can help traders make more informed decisions and automate trading processes.

- Evaluating the accuracy and reliability of machine learning predictions is important for assessing the effectiveness of trading strategies and minimizing risks.

Understanding Market Trends and Patterns

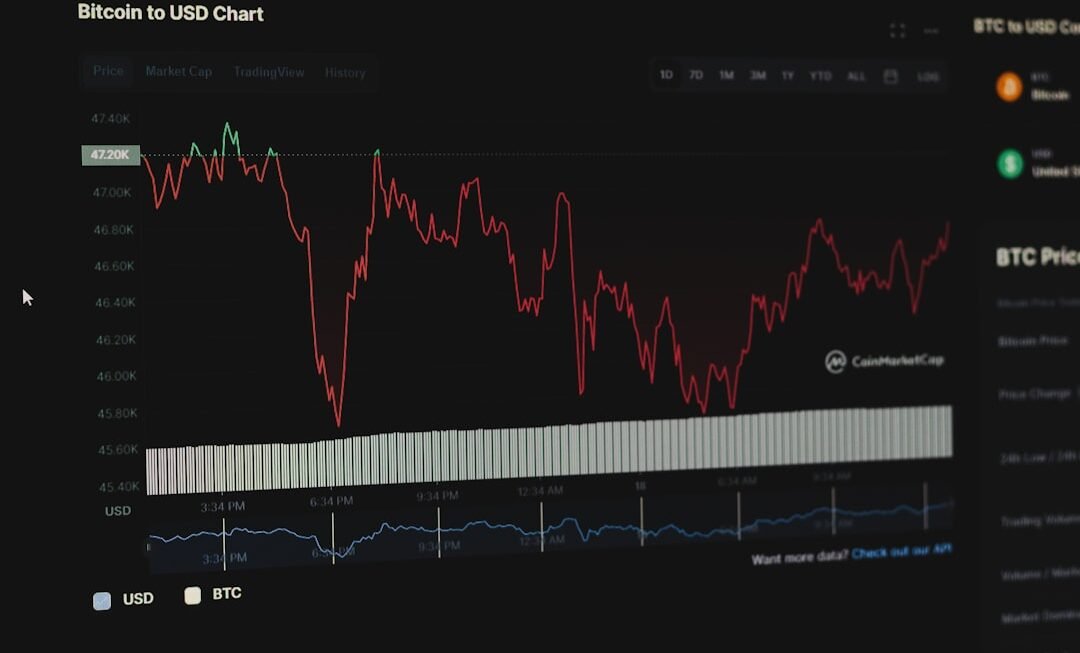

To effectively utilize machine learning in Forex trading, I must first grasp the fundamental concepts of market trends and patterns. The Forex market is influenced by a myriad of factors, including economic indicators, geopolitical events, and market sentiment. By analyzing these elements, I can begin to identify trends that may signal potential trading opportunities.

Machine learning algorithms excel at processing large datasets, allowing me to uncover hidden correlations and insights that would be difficult to discern through manual analysis. As I study historical price movements, I realize that trends can be classified into three main categories: upward trends, downward trends, and sideways trends. Each of these trends presents unique trading opportunities and risks.

Machine learning models can be trained to recognize these patterns by analyzing past price data and identifying key indicators that signal trend reversals or continuations. By leveraging these insights, I can make more informed trading decisions and potentially increase my profitability in the Forex market.

The Use of Historical Data in Machine Learning Models

One of the cornerstones of machine learning in Forex trading is the utilization of historical data. As I embark on this journey, I recognize that the quality and quantity of data I feed into my models will significantly impact their performance. Historical price data, along with relevant economic indicators and news events, serves as the foundation for training machine learning algorithms.

By analyzing this data, I can develop models that not only predict future price movements but also adapt to changing market conditions. In my exploration of historical data, I discover various sources from which I can obtain valuable information. These include financial databases, trading platforms, and even social media sentiment analysis.

By aggregating data from multiple sources, I can create a comprehensive dataset that reflects the complexities of the Forex market. This rich dataset allows my machine learning models to learn from past behaviors and make predictions based on a broader context, ultimately enhancing their accuracy and reliability.

Predictive Modeling and Algorithmic Trading

As I delve deeper into machine learning applications in Forex trading, I become increasingly fascinated by predictive modeling and algorithmic trading. Predictive modeling involves creating mathematical models that forecast future price movements based on historical data and identified patterns. By employing various machine learning techniques such as regression analysis, decision trees, and neural networks, I can develop models that provide actionable insights for my trading strategies.

Algorithmic trading takes this a step further by automating the execution of trades based on predefined criteria derived from my predictive models. This automation not only saves time but also allows me to capitalize on market opportunities in real-time without the emotional biases that often accompany manual trading decisions. As I implement algorithmic trading strategies powered by machine learning, I find myself better equipped to navigate the fast-paced Forex market while minimizing risks associated with human error.

Evaluating the Accuracy and Reliability of Machine Learning Predictions

While the potential of machine learning in Forex trading is immense, it is crucial for me to evaluate the accuracy and reliability of my predictions. This involves rigorous testing and validation of my models using various metrics such as precision, recall, and F1 score. By assessing these metrics, I can determine how well my models perform in predicting price movements and identify areas for improvement.

Additionally, backtesting plays a vital role in evaluating the effectiveness of my machine learning models. By applying my predictive algorithms to historical data, I can simulate how they would have performed in real-world trading scenarios. This process not only helps me gauge their accuracy but also allows me to refine my strategies based on empirical evidence.

As I continue to assess the performance of my models, I remain mindful of the importance of continuous improvement and adaptation to changing market conditions.

The Impact of Machine Learning on Forex Trading Strategies

Enhanced Trading Decisions

With machine learning, I can develop more accurate and informed trading strategies. By analyzing large datasets, I can identify complex patterns and relationships that may not be apparent through traditional methods. This allows me to make more precise predictions and execute trades with greater confidence.

Adaptive Strategies for a Dynamic Market

Machine learning algorithms can continuously learn from new data and adapt to changing market conditions. This adaptability is crucial in Forex trading, where market dynamics can shift rapidly due to external factors such as economic reports or geopolitical events. By using machine learning, I can stay ahead of the curve and respond to market changes in real-time.

Staying Ahead of the Competition

The integration of machine learning into my Forex trading strategies has given me a competitive edge. By leveraging the power of machine learning, I can analyze vast amounts of data, identify profitable opportunities, and execute trades with precision and speed. This enables me to stay ahead of the competition and achieve consistent returns in the ever-changing Forex market.

Challenges and Limitations of Machine Learning in Predicting Forex Market Trends

Despite its potential benefits, I must also acknowledge the challenges and limitations associated with using machine learning in Forex trading. One significant hurdle is the inherent unpredictability of financial markets. While machine learning models can identify patterns based on historical data, they cannot account for unforeseen events or sudden shifts in market sentiment that may impact currency prices.

Additionally, overfitting is a common concern when developing machine learning models. This occurs when a model becomes too complex and starts to capture noise rather than genuine patterns in the data. As a result, it may perform well on historical data but fail to generalize effectively to new data.

To mitigate this risk, I must strike a balance between model complexity and interpretability while ensuring that my models remain robust across different market conditions.

The Future of Machine Learning in Forex Trading

Looking ahead, I am optimistic about the future of machine learning in Forex trading. As technology continues to advance and more sophisticated algorithms are developed, I anticipate that machine learning will play an increasingly central role in shaping trading strategies. The ability to process vast amounts of data in real-time will empower traders like myself to make more informed decisions and respond swiftly to market changes.

Moreover, as financial markets become more interconnected and globalized, machine learning will enable me to analyze cross-market relationships and correlations that were previously difficult to discern. This holistic approach will enhance my understanding of market dynamics and improve my ability to identify profitable trading opportunities. In conclusion, my journey into the realm of machine learning in Forex trading has opened up new avenues for exploration and innovation.

By harnessing the power of data-driven insights and predictive modeling, I am better equipped to navigate the complexities of the Forex market while continuously refining my strategies for success. As I embrace this technological evolution, I remain committed to staying informed about emerging trends and advancements that will shape the future of Forex trading.