As I delve into the world of online options trading, I find myself captivated by the myriad opportunities it presents. The digital landscape has transformed the way I engage with financial markets, allowing me to trade options from the comfort of my home. Options trading, in essence, provides me with the flexibility to speculate on the future price movements of various assets without necessarily owning them outright.

This unique characteristic of options makes it an appealing choice for many traders, including myself, who seek to leverage their capital effectively. The allure of online options trading lies not only in its potential for profit but also in its accessibility. With just a few clicks, I can access a wealth of information, tools, and platforms that empower me to make informed decisions.

The ability to trade options online has democratized the financial markets, enabling individuals like me to participate in trading strategies that were once reserved for institutional investors. As I navigate this dynamic environment, I am constantly reminded of the importance of education and strategy in maximizing my chances of success.

Key Takeaways

- Online options trading provides a convenient platform for investors to trade options from anywhere with internet access.

- Understanding risk management is crucial in options trading to protect against potential losses and maximize profits.

- Setting stop-loss orders and limit orders helps to automate the process of cutting losses and locking in profits.

- Diversifying your options portfolio can help spread risk and potentially increase returns by investing in a variety of options contracts.

- Hedging strategies in options trading can help protect against adverse market movements and minimize potential losses.

Understanding Risk Management in Options Trading

Risk management is a cornerstone of my approach to options trading. I have come to realize that understanding and mitigating risk is essential for long-term success in this volatile market. Each trade I make carries inherent risks, and it is my responsibility to assess and manage those risks effectively.

By developing a solid risk management plan, I can protect my capital and ensure that I remain in the game even during challenging market conditions. One of the first steps I take in managing risk is to determine my risk tolerance. This involves evaluating my financial situation, investment goals, and emotional capacity for handling losses.

By establishing clear parameters for how much I am willing to risk on each trade, I can make more informed decisions and avoid impulsive actions driven by fear or greed. Additionally, I find it beneficial to continuously educate myself about various risk management techniques, such as using stop-loss orders and position sizing, which further enhance my ability to navigate the complexities of options trading.

Setting Stop-Loss Orders and Limit Orders

In my journey as an options trader, I have learned the significance of setting stop-loss orders and limit orders as part of my risk management strategy. A stop-loss order serves as a safety net, automatically closing my position when the price reaches a predetermined level. This tool allows me to limit potential losses and maintain discipline in my trading approach.

By implementing stop-loss orders, I can focus on my trading strategy without constantly monitoring market fluctuations. On the other hand, limit orders enable me to take advantage of favorable price movements while ensuring that I do not enter or exit a trade at an undesirable price. By setting a limit order, I can specify the exact price at which I want to buy or sell an option.

This approach not only helps me manage risk but also allows me to capitalize on market opportunities without succumbing to emotional decision-making. Together, these orders form a crucial part of my trading toolkit, providing me with greater control over my trades and enhancing my overall trading experience.

Diversifying Your Options Portfolio

As I continue to explore options trading, I have come to appreciate the importance of diversification in my portfolio. Just as a well-rounded investment strategy includes a mix of asset classes, diversifying my options portfolio helps mitigate risk and enhance potential returns. By spreading my investments across different sectors, underlying assets, and expiration dates, I can reduce the impact of adverse market movements on my overall portfolio.

Diversification also allows me to capitalize on various market conditions. For instance, if one sector is underperforming, another may be thriving, providing me with opportunities to offset losses. Additionally, by incorporating different types of options strategies—such as spreads, straddles, and strangles—I can further diversify my approach and adapt to changing market dynamics.

This multifaceted strategy not only helps protect my capital but also positions me for potential gains across a broader spectrum of market scenarios.

Hedging Strategies for Options Trading

In my pursuit of effective options trading, I have discovered the value of hedging strategies as a means of managing risk. Hedging involves taking positions that offset potential losses in my primary investments. By employing hedging techniques, I can create a safety net that protects my portfolio from adverse price movements while still allowing for potential gains.

One common hedging strategy I utilize is buying put options on assets I already own. This approach provides me with the right to sell my underlying asset at a predetermined price, effectively limiting my downside risk. Additionally, I have explored more complex strategies such as collars and protective puts, which offer varying degrees of protection while allowing for upside potential.

By incorporating hedging strategies into my trading plan, I can navigate market volatility with greater confidence and safeguard my investments against unforeseen events.

Using Technical Analysis to Manage Risk

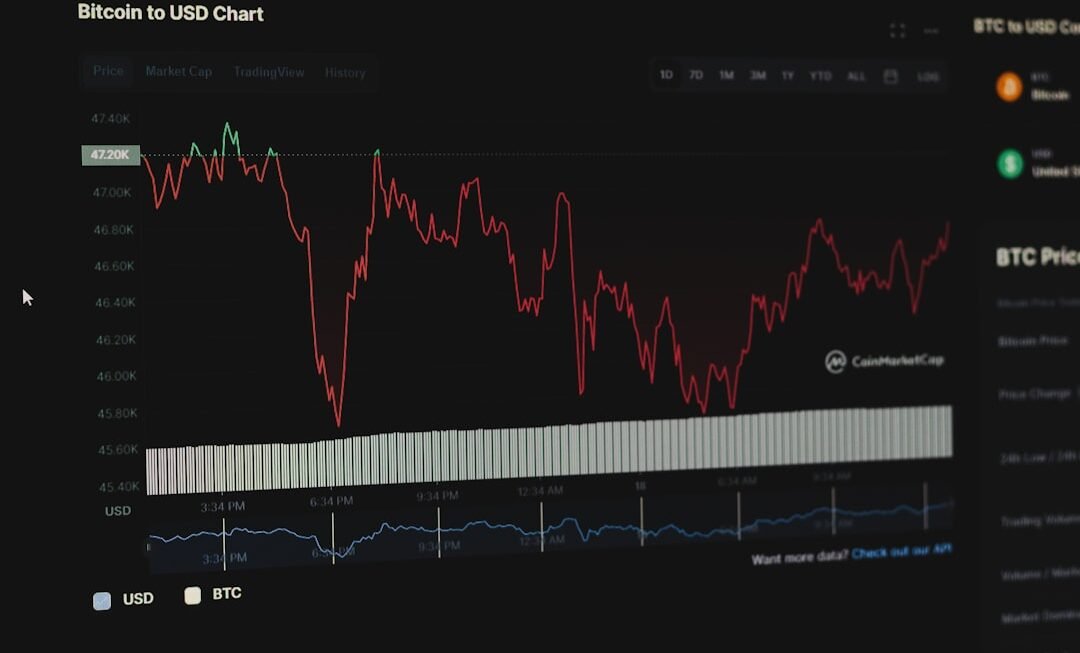

Technical analysis has become an essential component of my options trading strategy. By examining historical price patterns and market trends, I can make more informed decisions about when to enter or exit trades.

Identifying Key Levels

This analytical approach allows me to identify potential support and resistance levels, which are critical in determining optimal entry and exit points for my options trades.

Leveraging Technical Indicators

I often rely on various technical indicators—such as moving averages, Relative Strength Index (RSI), and Bollinger Bands—to gauge market sentiment and potential price movements. By combining these indicators with chart patterns, I can develop a comprehensive view of the market landscape.

Enhancing Decision-Making and Risk Management

This data-driven approach not only enhances my decision-making process but also helps me manage risk more effectively by providing insights into potential price reversals or continuations.

Implementing Position Sizing and Risk-Reward Ratios

Position sizing is another crucial aspect of my risk management strategy in options trading. By determining the appropriate size of each trade relative to my overall portfolio, I can ensure that no single trade poses an excessive risk to my capital. This disciplined approach allows me to maintain a balanced portfolio while minimizing the impact of any individual loss.

In conjunction with position sizing, I also pay close attention to risk-reward ratios when evaluating potential trades. By assessing the potential profit relative to the risk involved, I can make more informed decisions about which trades align with my overall trading strategy. A favorable risk-reward ratio not only enhances my chances of success but also reinforces my commitment to disciplined trading practices.

The Importance of Constant Monitoring and Adjustment

As I navigate the ever-changing landscape of options trading, I have come to understand that constant monitoring and adjustment are essential components of successful trading. The financial markets are dynamic and influenced by a multitude of factors—economic data releases, geopolitical events, and market sentiment—all of which can impact the performance of my options positions. Regularly reviewing my trades allows me to assess their performance and make necessary adjustments based on changing market conditions.

Whether it involves tightening stop-loss orders or re-evaluating my hedging strategies, staying proactive ensures that I remain aligned with my trading goals. Additionally, maintaining a trading journal has proven beneficial in tracking my progress and identifying areas for improvement. By reflecting on both successful trades and missteps, I can refine my approach and enhance my overall trading acumen.

In conclusion, online options trading offers a wealth of opportunities for those willing to invest time and effort into understanding its intricacies. Through effective risk management strategies—such as setting stop-loss orders, diversifying portfolios, employing hedging techniques, utilizing technical analysis, implementing position sizing, and maintaining constant monitoring—I can navigate this complex landscape with greater confidence. As I continue on this journey, I remain committed to learning and adapting, knowing that success in options trading requires both discipline and a willingness to evolve with the markets.