As I delve into the world of online options trading, I find myself captivated by the evolution of trading platforms that have transformed the way I engage with financial markets. The advent of technology has made it possible for individual traders like me to access sophisticated tools and resources that were once reserved for institutional investors. Online options trading platforms have democratized the trading landscape, allowing me to execute trades, analyze market trends, and manage my portfolio from the comfort of my home or on the go.

This article aims to explore the journey of these platforms, highlighting their early features, advancements in user experience, and the innovations that continue to shape the future of trading. The rise of online options trading platforms has not only made trading more accessible but has also empowered me with a wealth of information and resources. I can now make informed decisions based on real-time data and analytics, which was a far cry from the days when trading was confined to phone calls and paper tickets.

As I navigate through this digital landscape, I am constantly reminded of how far we have come and how these platforms have evolved to meet the needs of traders like myself.

Key Takeaways

- Online options trading platforms have revolutionized the way individuals can participate in the financial markets.

- Early features and functionality of online options trading platforms focused on providing basic trading capabilities and access to market data.

- Advancements in user interface and experience have made online options trading more intuitive and accessible to a wider audience.

- Integration of advanced analytics and charting tools has empowered traders to make more informed decisions and execute complex trading strategies.

- The rise of mobile trading apps has allowed traders to stay connected and manage their portfolios on the go.

Early Features and Functionality of Online Options Trading Platforms

Reflecting on the early days of online options trading platforms, I remember how rudimentary their features were compared to what we have today. Initially, these platforms offered basic functionalities such as order placement and simple charting tools. I recall spending hours trying to understand the limited data available, often relying on external sources for market analysis.

The user interfaces were often clunky and not particularly intuitive, making it a challenge for someone like me who was just starting out in trading. Despite these limitations, the early platforms laid the groundwork for what was to come. They introduced me to the concept of options trading and provided a glimpse into the potential of leveraging financial instruments for profit.

I learned how to place trades and monitor my positions, albeit with a steep learning curve. The simplicity of these early platforms allowed me to focus on understanding the fundamentals of options trading without being overwhelmed by excessive features. However, as I became more experienced, I yearned for more advanced tools that could enhance my trading strategies.

Advancements in User Interface and Experience

As technology progressed, so did the user interface and overall experience of online options trading platforms. I vividly remember the moment when I first encountered a platform that prioritized user experience. The sleek design, intuitive navigation, and customizable dashboards made it significantly easier for me to access the information I needed quickly.

The advancements in user interface design transformed my trading experience from a cumbersome task into an engaging activity. With these improvements, I found myself spending more time analyzing charts and market trends rather than struggling with navigation. The introduction of drag-and-drop features and customizable layouts allowed me to tailor my workspace according to my preferences.

This personalization made it easier for me to focus on my trading strategies and execute trades efficiently. The evolution of user experience has not only made trading more enjoyable but has also increased my confidence in making informed decisions.

Integration of Advanced Analytics and Charting Tools

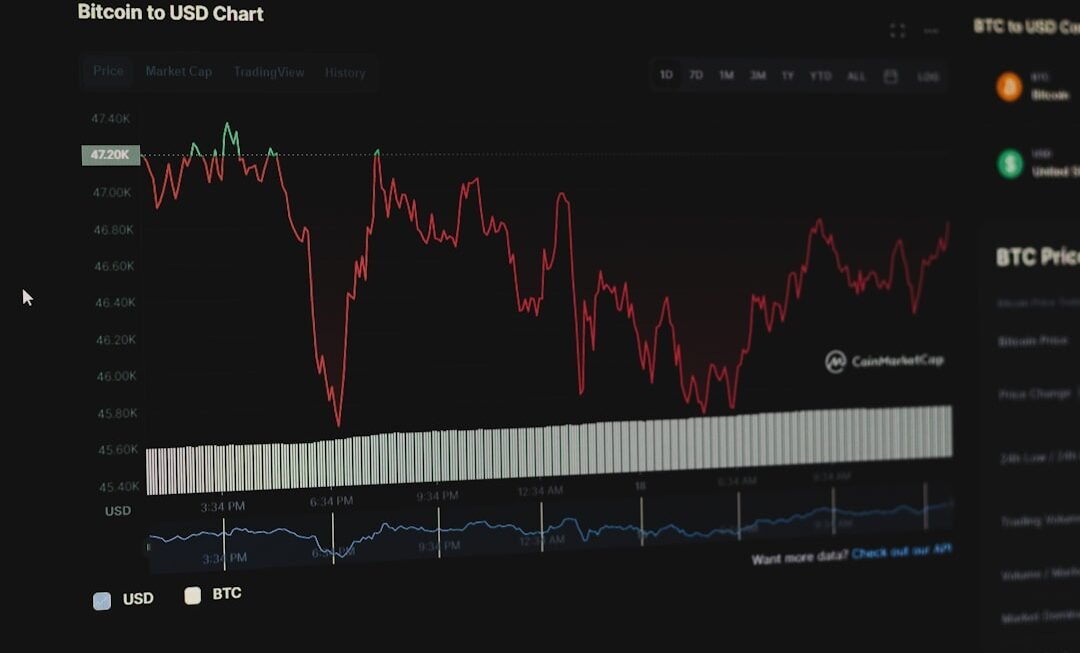

The integration of advanced analytics and charting tools into online options trading platforms has been a game-changer for me as a trader. Gone are the days when I had to rely solely on basic charts and limited data points. Today’s platforms offer a plethora of analytical tools that enable me to conduct in-depth market analysis with ease.

Features such as technical indicators, historical data comparisons, and real-time market feeds have become essential components of my trading toolkit. I find that these advanced analytics allow me to identify trends and patterns that would have been difficult to spot otherwise. The ability to overlay multiple indicators on a single chart provides me with a comprehensive view of market dynamics.

Additionally, many platforms now offer backtesting capabilities, allowing me to test my strategies against historical data before committing real capital. This level of analysis has significantly improved my decision-making process and has contributed to my overall success in options trading.

The Rise of Mobile Trading Apps

In an increasingly fast-paced world, the rise of mobile trading apps has revolutionized how I approach options trading. With the ability to trade on-the-go, I no longer feel tethered to my desktop computer. Whether I’m commuting, traveling, or simply enjoying a day out, I can access my trading account and execute trades with just a few taps on my smartphone.

This convenience has allowed me to stay connected to the markets at all times, ensuring that I never miss an opportunity. Mobile trading apps have also incorporated many of the advanced features found on desktop platforms, including real-time quotes, charting tools, and news feeds. I appreciate being able to monitor my portfolio and receive alerts about significant market movements directly on my phone.

The seamless integration of mobile technology into trading has not only enhanced my flexibility but has also made it easier for me to react quickly to changing market conditions.

Innovations in Risk Management and Portfolio Analysis

Empowering Informed Decision-Making

As I continue my journey in options trading, I have come to realize the importance of effective risk management and portfolio analysis. Innovations in this area have significantly improved my ability to assess risk and make informed decisions about my investments. Many online options trading platforms now offer sophisticated risk management tools that allow me to set stop-loss orders, analyze potential losses, and evaluate the overall risk exposure of my portfolio.

Proactive Risk Management through Simulation

These tools have empowered me to take a more proactive approach to managing my investments. For instance, I can simulate different scenarios based on market fluctuations and assess how they would impact my portfolio’s performance. This level of analysis has not only increased my confidence in executing trades but has also helped me develop a more disciplined approach to risk management.

Strategic Decision-Making through Risk Assessment

By understanding the potential risks associated with each trade, I can make more strategic decisions that align with my overall investment goals.

Expansion of Educational Resources and Community Engagement

One aspect that has greatly enriched my experience as an options trader is the expansion of educational resources and community engagement offered by online platforms. Many trading platforms now provide comprehensive educational materials, including webinars, tutorials, and articles that cater to traders at all skill levels. These resources have been invaluable in helping me deepen my understanding of options trading strategies and market dynamics.

Moreover, the sense of community fostered by these platforms has allowed me to connect with other traders who share similar interests. Online forums and social media groups provide spaces for discussion, idea exchange, and support. Engaging with fellow traders has not only enhanced my knowledge but has also motivated me to stay committed to continuous learning.

The collaborative environment encourages me to share my experiences while gaining insights from others who have faced similar challenges in their trading journeys.

The Future of Online Options Trading Platforms: Artificial Intelligence and Automation

Looking ahead, I am excited about the future of online options trading platforms, particularly with the integration of artificial intelligence (AI) and automation technologies. As these innovations continue to evolve, I anticipate that they will further enhance my trading experience by providing personalized insights and recommendations based on my trading behavior and preferences. AI-driven algorithms could analyze vast amounts of data in real-time, identifying patterns that may not be immediately apparent to human traders like myself.

Automation is another area where I see tremendous potential for improving efficiency in options trading. The ability to set automated trading strategies based on predefined criteria would allow me to execute trades without constantly monitoring the markets. This could free up valuable time while ensuring that I don’t miss out on opportunities due to human error or emotional decision-making.

In conclusion, as I reflect on the journey of online options trading platforms from their early days to their current state, it is clear that technology has played a pivotal role in shaping my experience as a trader. The advancements in user interface design, analytics tools, mobile accessibility, risk management innovations, educational resources, and future AI integration all contribute to a more dynamic and empowering trading environment. As I look forward to what lies ahead in this ever-evolving landscape, I am filled with optimism about the possibilities that technology will continue to unlock for traders like myself.