As I delve into the world of cryptocurrency, one of the most intriguing concepts that captures my attention is arbitrage. At its core, cryptocurrency arbitrage involves taking advantage of price discrepancies for the same asset across different exchanges. This practice is not unique to cryptocurrencies; it has been a staple in traditional finance for decades.

However, the volatile nature of digital currencies creates a fertile ground for arbitrage opportunities. By buying low on one exchange and selling high on another, I can potentially profit from these price differences. The allure of cryptocurrency arbitrage lies in its simplicity and the potential for quick gains.

Unlike traditional investments that may require extensive research and a long-term commitment, arbitrage can yield immediate results. I find it fascinating how the decentralized nature of cryptocurrencies allows for these discrepancies to exist. Factors such as market demand, trading volume, and even geographical location can influence prices across exchanges, creating a dynamic environment ripe for exploitation.

As I explore this realm, I am constantly reminded of the importance of speed and efficiency in executing trades to capitalize on fleeting opportunities.

Key Takeaways

- Cryptocurrency arbitrage involves taking advantage of price differences across different exchanges to make a profit.

- Traders can identify price differences by comparing the prices of the same cryptocurrency on different exchanges.

- Utilizing arbitrage opportunities can be profitable, but it requires quick and efficient execution to capitalize on the price differences.

- Risks and challenges of cryptocurrency arbitrage include exchange fees, price volatility, and the potential for technical issues.

- Successful arbitrage requires the use of tools such as trading bots and strategies like triangular arbitrage to maximize profit potential.

Identifying Price Differences Across Online Exchanges

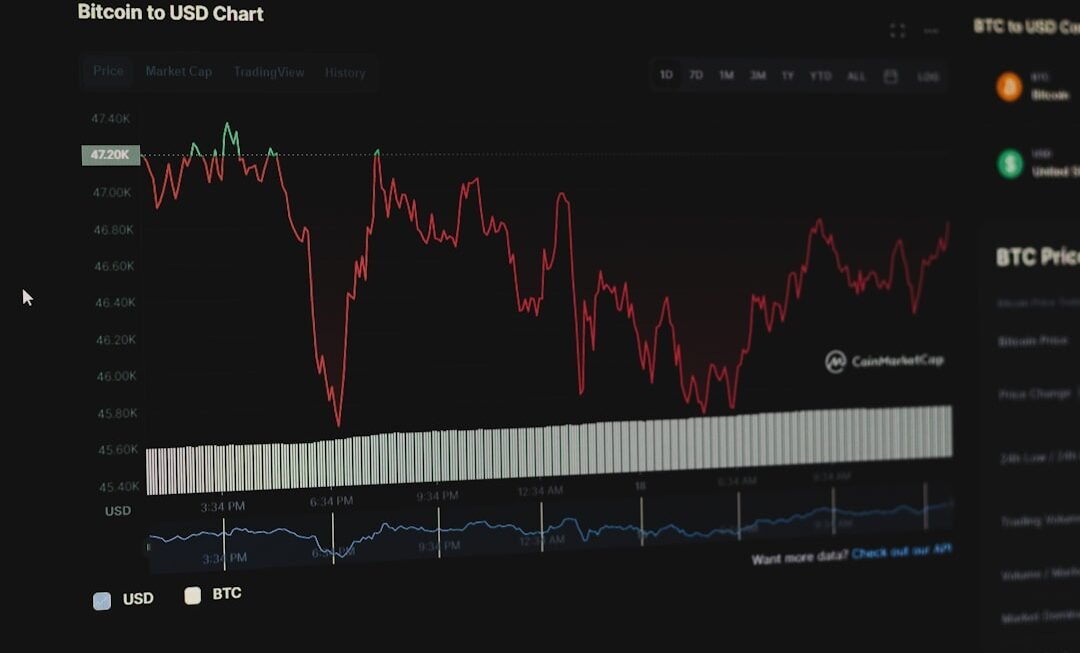

To successfully engage in cryptocurrency arbitrage, I must first identify price differences across various online exchanges. This process requires a keen eye and a systematic approach. I often start by monitoring multiple exchanges simultaneously, using tools and platforms that aggregate price data in real-time.

By comparing prices for the same cryptocurrency across different platforms, I can pinpoint where the most lucrative opportunities lie. One of the challenges I face is the sheer number of exchanges available today. Each platform has its own user interface, fee structure, and liquidity levels, which can complicate my analysis.

I have learned to focus on a select few exchanges that are known for their reliability and trading volume. By narrowing my scope, I can more effectively track price movements and make informed decisions. Additionally, I pay close attention to market trends and news that may impact prices, as these factors can create sudden shifts in the market landscape.

Utilizing Arbitrage Opportunities for Profit

Once I have identified a price discrepancy, the next step is to act swiftly to capitalize on the arbitrage opportunity. Timing is crucial in this fast-paced environment; prices can change within seconds, and what may have been a profitable trade moments ago could quickly turn unprofitable. To maximize my chances of success, I often employ automated trading bots that execute trades on my behalf.

These bots can react to market changes much faster than I can manually, allowing me to seize opportunities as they arise. In addition to speed, I also consider transaction fees when calculating potential profits. Each exchange has its own fee structure, which can significantly impact my overall gains.

I meticulously calculate the costs associated with buying and selling on different platforms to ensure that my trades remain profitable after accounting for these expenses. This level of diligence is essential; otherwise, I risk eroding my profits through oversight or miscalculation.

Risks and Challenges of Cryptocurrency Arbitrage

Despite the potential for profit, cryptocurrency arbitrage is not without its risks and challenges. One of the most significant concerns is market volatility. The very nature of cryptocurrencies means that prices can fluctuate wildly within short periods.

A trade that appears profitable at one moment may turn into a loss by the time I execute it due to rapid price changes. This inherent volatility requires me to be vigilant and ready to adapt my strategy at a moment’s notice. Another challenge I face is liquidity.

Not all exchanges have the same level of trading volume, which can lead to difficulties when trying to execute large trades. If I attempt to buy or sell a significant amount of cryptocurrency on a low-volume exchange, I may inadvertently drive the price up or down, negating any potential profit from the arbitrage opportunity. To mitigate this risk, I often limit the size of my trades and focus on exchanges with higher liquidity levels.

Tools and Strategies for Successful Arbitrage

To navigate the complexities of cryptocurrency arbitrage successfully, I rely on a variety of tools and strategies. One essential tool in my arsenal is price tracking software that provides real-time data on cryptocurrency prices across multiple exchanges. This software allows me to quickly identify discrepancies and make informed decisions about where to trade.

In addition to tracking tools, I also utilize trading bots that automate my trading strategies. These bots can execute trades based on predefined parameters, allowing me to take advantage of opportunities even when I’m not actively monitoring the market. By setting specific criteria for when to buy or sell, I can ensure that my trades align with my overall strategy while minimizing emotional decision-making.

Moreover, I continuously educate myself about market trends and emerging technologies in the cryptocurrency space. Staying informed about new developments helps me anticipate potential arbitrage opportunities before they arise. By combining technology with ongoing education, I position myself for success in this ever-evolving landscape.

Legal and Regulatory Considerations in Cryptocurrency Arbitrage

As I engage in cryptocurrency arbitrage, it is crucial for me to be aware of the legal and regulatory landscape surrounding this practice. Different countries have varying regulations regarding cryptocurrency trading, and compliance is essential to avoid potential legal issues. In some jurisdictions, arbitrage may be viewed as market manipulation or insider trading, which could lead to severe penalties.

I make it a priority to stay informed about the regulations in my country and any other regions where I may be trading. This includes understanding tax implications related to cryptocurrency transactions, as profits from arbitrage may be subject to taxation. By keeping abreast of legal developments and ensuring compliance with relevant laws, I can protect myself from potential legal repercussions while engaging in arbitrage activities.

Additionally, I recognize that regulatory changes can impact market dynamics significantly. For instance, if a country imposes stricter regulations on cryptocurrency exchanges, it could lead to reduced liquidity or increased fees on those platforms. Being proactive in understanding these changes allows me to adjust my strategies accordingly and maintain a competitive edge.

Case Studies of Successful Cryptocurrency Arbitrage

To better understand the practical application of cryptocurrency arbitrage, I often analyze case studies of successful traders who have navigated this landscape effectively. One notable example involves a trader who capitalized on price discrepancies between two major exchanges during a period of heightened volatility. By executing rapid trades across both platforms, this trader was able to generate substantial profits within a matter of hours.

In another case study, a group of traders utilized advanced algorithms to identify arbitrage opportunities across multiple exchanges simultaneously. By pooling their resources and leveraging technology, they were able to execute trades at lightning speed, significantly increasing their profit margins compared to individual traders operating alone. These examples illustrate not only the potential for profit but also the importance of collaboration and technological innovation in achieving success in cryptocurrency arbitrage.

The Future of Cryptocurrency Arbitrage

As I look ahead to the future of cryptocurrency arbitrage, I am filled with both excitement and caution. The rapid evolution of technology and market dynamics suggests that new opportunities will continue to emerge. However, this also means that competition will intensify as more traders enter the space seeking similar profits.

I anticipate that advancements in artificial intelligence and machine learning will play a significant role in shaping the future of arbitrage strategies. These technologies could enable traders like myself to analyze vast amounts of data more efficiently and identify opportunities that may have previously gone unnoticed. Additionally, as regulatory frameworks become more established globally, I expect greater stability in the market, which could lead to more predictable arbitrage opportunities.

In conclusion, while cryptocurrency arbitrage presents numerous opportunities for profit, it also comes with its share of risks and challenges. By understanding the intricacies of this practice and employing effective tools and strategies, I can navigate this dynamic landscape successfully. As I continue my journey in cryptocurrency trading, I remain committed to staying informed and adaptable in an ever-changing environment.