Diversification is a key principle in online trading that involves distributing investments across various assets to mitigate risk and optimize returns. This strategy aims to reduce the impact of market fluctuations on overall investment performance by leveraging the fact that different assets often do not move in perfect synchronization. When one asset underperforms, others may outperform, potentially balancing the overall portfolio returns.

Investors can achieve diversification by allocating funds across multiple asset classes, including stocks, bonds, commodities, and currencies. Further diversification can be accomplished by investing in different industries or geographical regions. In the realm of online trading, diversification may also encompass trading various financial instruments, such as forex and cryptocurrencies, to create a comprehensive portfolio.

A thorough understanding of diversification principles is essential for online traders seeking to develop a robust and balanced investment approach. By implementing a well-diversified strategy, traders can potentially enhance their ability to weather market volatility and achieve long-term financial goals.

Exploring the Benefits of Diversifying into Forex and Cryptocurrency

Forex: The Largest and Most Liquid Market

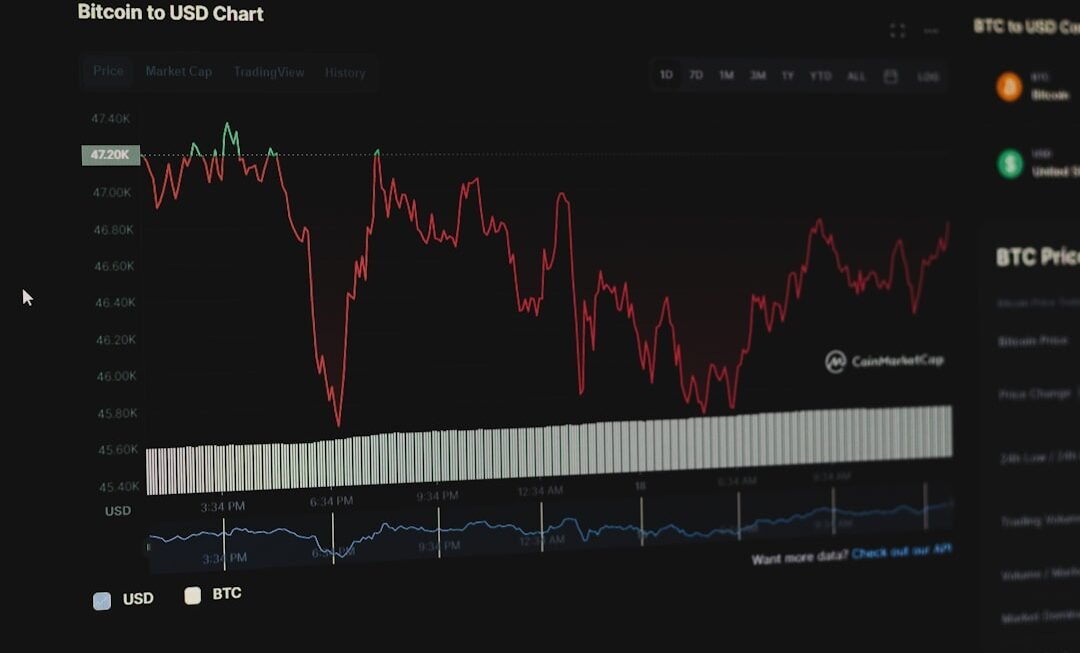

Forex, or foreign exchange, is the largest and most liquid market in the world, with a daily trading volume of over $6 trillion. Trading forex allows investors to take advantage of the fluctuations in exchange rates between different currencies, providing ample opportunities for profit.

Cryptocurrency: A Rapidly Growing Market

Cryptocurrency, on the other hand, is a relatively new and rapidly growing market that operates independently of traditional financial systems. Investing in cryptocurrency can offer diversification benefits due to its low correlation with other asset classes, potentially providing a hedge against market downturns.

Benefits of Diversification

By diversifying into forex and cryptocurrency, traders can access a wider range of investment opportunities and spread their risk across different markets. This can help mitigate the impact of adverse market conditions on their overall portfolio performance. Additionally, both forex and cryptocurrency markets operate 24/7, allowing traders to take advantage of global market movements at any time. Exploring the benefits of diversifying into these markets can provide online traders with the potential for enhanced returns and a more resilient investment strategy.

Identifying Key Factors for Building a Diversified Portfolio

Building a diversified portfolio requires careful consideration of several key factors. Firstly, it is essential to assess your risk tolerance and investment goals to determine the appropriate mix of assets for your portfolio. Understanding your risk tolerance will help you allocate your investments across different asset classes in a way that aligns with your comfort level and long-term objectives.

Additionally, considering the correlation between different assets is crucial for effective diversification. Investing in assets that have low or negative correlations with each other can help spread risk more effectively. Furthermore, identifying key economic and market trends can inform your asset allocation decisions.

For example, if you anticipate a downturn in a specific industry or region, you may consider reallocating your investments to mitigate potential losses. Additionally, staying informed about geopolitical events and policy changes can help you anticipate market movements and adjust your portfolio accordingly. By identifying these key factors, you can build a diversified portfolio that is well-positioned to weather market fluctuations and achieve long-term success in online trading.

Strategies for Balancing Risk and Return in Forex and Cryptocurrency Trading

Balancing risk and return is a critical aspect of successful forex and cryptocurrency trading. One strategy for achieving this balance is to diversify across different currency pairs in the forex market. By trading a mix of major, minor, and exotic currency pairs, traders can spread their risk and take advantage of diverse market opportunities.

Additionally, incorporating different trading strategies, such as trend following, range trading, and breakout trading, can further diversify risk and potentially enhance returns. In the cryptocurrency market, balancing risk and return can be achieved by diversifying across different types of cryptocurrencies. Investing in a mix of established cryptocurrencies like Bitcoin and Ethereum, as well as emerging altcoins, can help spread risk and capture opportunities across the market.

Furthermore, implementing risk management techniques such as setting stop-loss orders and position sizing can help control downside risk while allowing for potential upside gains. By employing these strategies, traders can effectively balance risk and return in their forex and cryptocurrency trading activities.

Selecting the Right Mix of Assets for a Diversified Portfolio

Selecting the right mix of assets for a diversified portfolio requires careful consideration of various factors. One approach is to allocate investments across different asset classes, such as stocks, bonds, commodities, and currencies, to achieve broad diversification. Within each asset class, further diversification can be achieved by investing in different industries or sectors to spread risk.

Additionally, considering the correlation between assets is crucial for selecting the right mix. Investing in assets with low correlations can help create a more resilient portfolio. In the context of forex and cryptocurrency trading, selecting the right mix of assets involves choosing currency pairs and cryptocurrencies with diverse characteristics and market dynamics.

For example, in forex trading, pairing major currencies with emerging market currencies can provide exposure to different economic conditions and geopolitical factors. In cryptocurrency trading, diversifying across established cryptocurrencies and newer blockchain projects can offer exposure to different segments of the market. By selecting the right mix of assets across various markets, traders can build a diversified portfolio that is well-positioned to capture opportunities and manage risk effectively.

Implementing a Diversification Plan for Long-Term Success in Online Trading

Regular Portfolio Review and Rebalancing

Regularly reviewing and rebalancing your portfolio can help maintain diversification as market conditions evolve. Incorporating a systematic approach to diversification can also involve utilizing investment tools such as exchange-traded funds (ETFs) and mutual funds that offer exposure to a diversified range of assets within a single investment vehicle. These instruments can provide efficient access to diversified portfolios across different markets and asset classes.

Leveraging Technology for Efficient Diversification

Furthermore, leveraging technology such as algorithmic trading systems and automated portfolio management platforms can help streamline the implementation of your diversification plan.

Achieving Long-Term Success in Online Trading

By implementing a comprehensive diversification plan, online traders can position themselves for long-term success in the dynamic world of online trading.

Monitoring and Adjusting Your Diversified Portfolio for Optimal Performance

Monitoring and adjusting your diversified portfolio is crucial for maintaining optimal performance over time. Regularly reviewing your portfolio’s performance against your investment objectives and risk tolerance will help identify any necessary adjustments. This may involve rebalancing your asset allocation to ensure that it remains aligned with your long-term goals and risk tolerance levels.

Additionally, staying informed about market trends and economic developments can inform your decision-making process. In the context of forex and cryptocurrency trading, monitoring market conditions and adjusting your portfolio may involve adapting to changes in exchange rates, interest rates, and geopolitical events that impact currency values. For cryptocurrency trading, staying abreast of technological developments and regulatory changes can inform your investment decisions.

Leveraging fundamental and technical analysis techniques can also provide insights into market trends and potential opportunities for portfolio adjustments. By actively monitoring and adjusting your diversified portfolio, you can optimize its performance and adapt to changing market conditions for sustained success in online trading.