E-Trade has emerged as a significant player in the realm of online trading, particularly with the introduction of cryptocurrency options. These options allow traders to speculate on the future price movements of various cryptocurrencies without the need to own the underlying assets. By purchasing options, traders can gain exposure to the volatile cryptocurrency market while potentially limiting their risk.

This innovative approach combines traditional trading strategies with the unique characteristics of digital currencies, making it an attractive option for both seasoned investors and newcomers alike. The mechanics of E-Trade cryptocurrency options are relatively straightforward. Traders can buy call options, which give them the right to purchase a cryptocurrency at a predetermined price within a specified timeframe, or put options, which allow them to sell a cryptocurrency at a set price before expiration.

This flexibility enables traders to implement various strategies based on their market outlook, whether they anticipate rising or falling prices. As the cryptocurrency market continues to evolve, E-Trade’s offerings provide a platform for traders to engage with these digital assets in a more structured and strategic manner.

Benefits of E-Trade Cryptocurrency Options

One of the primary benefits of E-Trade cryptocurrency options is the potential for high returns with limited capital investment. Options trading allows individuals to control a larger position in a cryptocurrency without having to invest the full amount required to purchase the asset outright. This leverage can amplify profits if the market moves in the trader’s favor, making it an appealing choice for those looking to maximize their investment potential.

Additionally, E-Trade’s platform offers a user-friendly interface and robust research tools that can enhance the trading experience. Traders have access to real-time market data, advanced charting capabilities, and educational resources that can help them make informed decisions. The ability to analyze market trends and historical data empowers traders to develop strategies tailored to their risk tolerance and investment goals.

Furthermore, E-Trade’s reputation as a well-established brokerage provides an added layer of confidence for those venturing into the world of cryptocurrency options.

Risks and Challenges of E-Trade Cryptocurrency Options

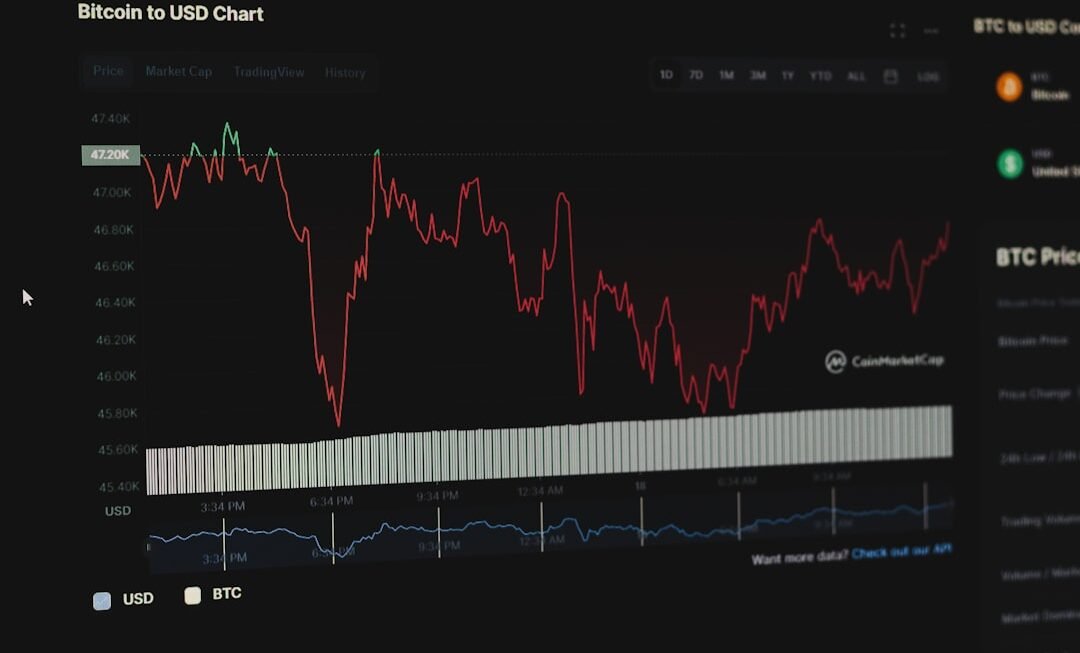

Despite the numerous advantages associated with E-Trade cryptocurrency options, there are inherent risks that traders must consider. The cryptocurrency market is notoriously volatile, with prices capable of experiencing dramatic fluctuations within short periods. This volatility can lead to significant losses, particularly for those who engage in options trading without a solid understanding of the underlying market dynamics.

Traders must be prepared for the possibility that their options may expire worthless if the market does not move in their favor. Moreover, the complexity of options trading can pose challenges for inexperienced investors. Unlike traditional stock trading, options require a deeper understanding of various strategies and terminologies, such as strike prices, expiration dates, and implied volatility.

New traders may find themselves overwhelmed by these concepts, leading to poor decision-making and potential financial losses. It is crucial for individuals to educate themselves thoroughly before diving into E-Trade cryptocurrency options to mitigate these risks effectively. The relevant word in the text is “implied volatility.” Here is the high authority source link for the word: implied volatility

How to Get Started with E-Trade Cryptocurrency Options

Getting started with E-Trade cryptocurrency options involves several key steps that can set traders on the path to success. First and foremost, individuals must create an account with E-Trade, which requires providing personal information and completing necessary verification processes. Once the account is established, traders can fund it through various methods, such as bank transfers or wire transfers, allowing them to begin trading.

After funding their accounts, traders should take advantage of E-Trade’s educational resources and tools designed to enhance their understanding of options trading. Engaging with webinars, tutorials, and articles can provide valuable insights into market trends and effective trading strategies. Additionally, utilizing E-Trade’s paper trading feature allows individuals to practice trading without risking real money, enabling them to build confidence and refine their skills before committing actual capital.

Popular Cryptocurrencies Available on E-Trade

E-Trade offers a diverse selection of cryptocurrencies for trading, catering to various investor preferences and strategies. Bitcoin remains the most prominent option available on the platform, often regarded as the gold standard of digital currencies. Its widespread acceptance and established market presence make it a popular choice among traders looking for stability amidst the volatility of other cryptocurrencies.

In addition to Bitcoin, E-Trade provides access to other notable cryptocurrencies such as Ethereum, Litecoin, and Bitcoin Cash. Each of these digital assets has unique features and use cases that appeal to different segments of the trading community. For instance, Ethereum’s smart contract functionality has garnered significant attention from developers and investors alike, while Litecoin’s faster transaction times make it an attractive alternative for those seeking efficiency in their transactions.

By offering a range of cryptocurrencies, E-Trade enables traders to diversify their portfolios and explore various investment opportunities within the digital asset space.

Tips for Successful E-Trade Cryptocurrency Trading

To navigate the complexities of E-Trade cryptocurrency trading successfully, individuals should consider implementing several key strategies. First and foremost, developing a well-defined trading plan is essential. This plan should outline specific goals, risk tolerance levels, and entry and exit strategies tailored to individual preferences.

By having a clear roadmap in place, traders can make more informed decisions and avoid impulsive actions driven by market emotions. Additionally, staying informed about market trends and news is crucial for successful trading. The cryptocurrency landscape is constantly evolving, with new developments impacting prices and investor sentiment.

Following reputable news sources and engaging with online communities can provide valuable insights into market movements and emerging trends. Furthermore, utilizing technical analysis tools available on E-Trade’s platform can help traders identify potential entry points and exit strategies based on historical price patterns.

Regulation and Security in E-Trade Cryptocurrency Trading

As cryptocurrency trading continues to gain traction, regulatory considerations have become increasingly important for investors. E-Trade operates within a regulated framework that adheres to industry standards aimed at protecting investors’ interests. This regulatory oversight provides a level of assurance for traders who may be concerned about the legitimacy and security of their investments.

Security is another critical aspect of E-Trade’s cryptocurrency trading environment. The platform employs advanced security measures to safeguard users’ accounts and personal information from potential threats. Two-factor authentication (2FA), encryption protocols, and regular security audits are just a few examples of the measures in place to enhance user safety.

By prioritizing security and compliance with regulations, E-Trade aims to create a trustworthy environment for individuals looking to engage in cryptocurrency trading.

Future Trends in E-Trade Cryptocurrency Options

Looking ahead, several trends are likely to shape the future of E-Trade cryptocurrency options and the broader digital asset landscape. One notable trend is the increasing integration of blockchain technology across various industries. As more companies recognize the potential benefits of blockchain solutions, demand for cryptocurrencies may rise, leading to greater interest in options trading as a means of capitalizing on this growth.

Additionally, advancements in technology are expected to enhance trading platforms like E-Trade further. Innovations such as artificial intelligence (AI) and machine learning could provide traders with more sophisticated tools for analyzing market data and predicting price movements. These technological advancements may empower traders to make more informed decisions while navigating the complexities of cryptocurrency options.

In conclusion, E-Trade cryptocurrency options present an exciting opportunity for investors seeking exposure to the dynamic world of digital assets. While there are risks involved, understanding the mechanics of options trading and leveraging available resources can lead to successful outcomes. As the cryptocurrency landscape continues to evolve, staying informed about regulatory developments and emerging trends will be essential for traders looking to thrive in this rapidly changing environment.

FAQs

What is e-trade cryptocurrency?

E-trade cryptocurrency refers to the buying, selling, and trading of digital currencies through an online platform or exchange. E-trade platforms allow users to invest in various cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

How does e-trade cryptocurrency work?

E-trade cryptocurrency platforms provide a digital marketplace where users can create accounts, deposit funds, and trade various cryptocurrencies. Users can place buy or sell orders for different digital currencies, and the platform matches these orders with other users on the platform.

Is e-trade cryptocurrency safe?

E-trade cryptocurrency platforms employ various security measures such as encryption, two-factor authentication, and cold storage to protect users’ funds and personal information. However, it’s important for users to research and choose reputable e-trade platforms with a strong track record of security.

What are the fees associated with e-trade cryptocurrency?

E-trade cryptocurrency platforms typically charge fees for transactions, such as trading fees, withdrawal fees, and deposit fees. These fees can vary depending on the platform and the type of transaction being conducted.

Can I trade traditional assets on e-trade cryptocurrency platforms?

Some e-trade cryptocurrency platforms offer the ability to trade traditional assets such as stocks, bonds, and ETFs alongside cryptocurrencies. This allows users to manage their entire investment portfolio in one place.

What are the benefits of using e-trade cryptocurrency?

E-trade cryptocurrency platforms provide users with access to a wide range of digital currencies, the ability to trade 24/7, and the potential for high returns on investment. Additionally, e-trade platforms often offer advanced trading tools and resources for users to make informed investment decisions.