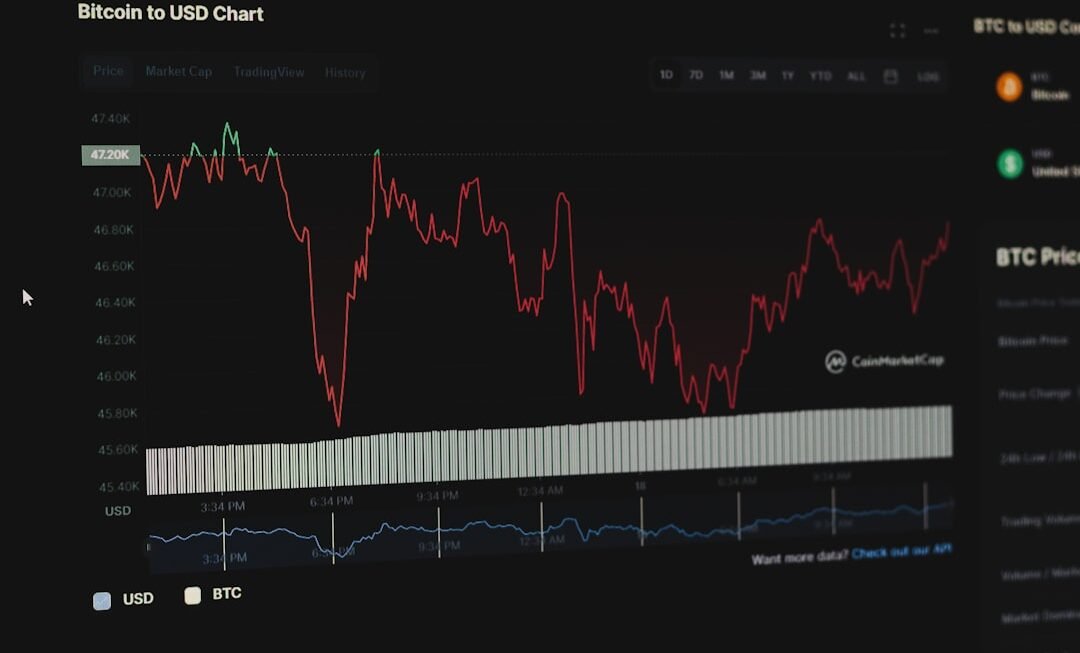

Volatility is a defining characteristic of cryptocurrency markets, setting them apart from traditional financial markets. This volatility is primarily driven by the nascent nature of the crypto space, where market sentiment can shift dramatically in a matter of hours or even minutes. Factors such as regulatory news, technological advancements, and macroeconomic trends can lead to significant price fluctuations.

Such volatility presents both opportunities and risks for traders, making it essential to understand the underlying dynamics that contribute to these price movements. The psychological aspect of volatility cannot be overlooked.

Traders often react emotionally to rapid price changes, leading to impulsive decisions that can exacerbate losses or miss out on potential gains. The fear of missing out (FOMO) and the fear of loss are powerful motivators that can cloud judgment. Understanding how market sentiment influences price movements is crucial for day traders who aim to capitalize on short-term fluctuations.

By analyzing historical price data and recognizing patterns, traders can better anticipate potential market reactions to news events or shifts in investor sentiment, thereby positioning themselves advantageously in a highly volatile environment.

Setting Up a Day Trading Strategy

Selecting the Right Assets

One effective approach is to focus on specific cryptocurrencies that exhibit consistent trading volume and volatility. For example, major coins like Bitcoin and Ethereum often provide ample opportunities for day traders due to their liquidity and frequent price movements. By concentrating on a select few assets, traders can develop a deeper understanding of their behavior and market dynamics.

Defining Entry and Exit Rules

In addition to selecting the right assets, a day trading strategy should incorporate clear entry and exit rules. These rules can be based on technical indicators, chart patterns, or specific price levels. For instance, a trader might decide to enter a position when a cryptocurrency breaks above a significant resistance level with high trading volume, signaling potential upward momentum. Conversely, exit strategies should also be predefined; this could involve setting profit targets or using trailing stops to lock in gains as the price moves favorably.

Reducing Impulsive Decisions

By adhering to a structured strategy, traders can reduce the likelihood of making impulsive decisions driven by market noise.

Identifying Entry and Exit Points

Identifying optimal entry and exit points is crucial for maximizing profits in day trading.

One common method is to use support and resistance levels, which are price points where an asset tends to reverse direction.

For example, if a cryptocurrency consistently bounces off a particular support level, traders may view this as an opportunity to enter a long position when the price approaches that level again. Conversely, if the price nears a resistance level where it has previously struggled to break through, traders might consider this an ideal point to exit or short the asset. Another effective technique for determining entry and exit points is the use of candlestick patterns.

These patterns provide insights into market sentiment and potential reversals. For instance, a bullish engulfing pattern may indicate strong buying pressure, suggesting that it could be an opportune moment to enter a long position. On the other hand, bearish patterns like shooting stars can signal potential reversals in an uptrend, prompting traders to consider exiting their positions.

By combining these techniques with real-time market analysis, traders can enhance their ability to make informed decisions regarding when to enter or exit trades.

Using Technical Analysis Tools

Technical analysis tools are indispensable for day traders seeking to navigate the complexities of cryptocurrency markets effectively. These tools provide valuable insights into price trends, momentum, and potential reversals, enabling traders to make data-driven decisions. One widely used tool is the moving average, which smooths out price data over a specified period to identify trends.

For instance, a trader might use a 50-day moving average to determine the overall trend direction; if the price is consistently above this average, it may indicate a bullish trend. In addition to moving averages, other technical indicators such as Relative Strength Index (RSI) and Bollinger Bands can offer further insights into market conditions. The RSI measures the speed and change of price movements, helping traders identify overbought or oversold conditions.

A reading above 70 may suggest that an asset is overbought and due for a correction, while a reading below 30 could indicate an oversold condition ripe for a rebound. Bollinger Bands, on the other hand, provide visual cues about volatility and potential price breakouts. When prices approach the upper band, it may signal overbought conditions, while prices near the lower band could indicate oversold conditions.

Managing Risk and Position Sizing

Effective risk management is paramount in day trading, particularly in the volatile cryptocurrency markets where significant losses can occur rapidly. One fundamental principle of risk management is position sizing—determining how much capital to allocate to each trade based on individual risk tolerance and account size. A common rule of thumb is to risk no more than 1% or 2% of total capital on any single trade.

This approach helps protect against catastrophic losses while allowing for consistent participation in the market. In addition to position sizing, implementing stop-loss orders is another critical component of risk management. A stop-loss order automatically sells an asset when it reaches a predetermined price level, limiting potential losses on a trade.

For example, if a trader enters a long position at $1,000 with a stop-loss set at $950, they will exit the trade if the price falls below that threshold. This strategy not only protects capital but also instills discipline by removing emotional decision-making from the equation. By combining prudent position sizing with effective stop-loss strategies, traders can navigate the inherent risks of day trading while maintaining their capital over time.

Staying Informed and Adapting to Market Changes

In the fast-evolving world of cryptocurrency trading, staying informed about market developments is essential for success. News events can have immediate and profound impacts on prices; therefore, traders must be vigilant in monitoring relevant information sources. This includes following reputable news outlets that cover cryptocurrency developments, engaging with online communities such as forums and social media platforms, and utilizing news aggregators that compile updates from various sources.

For instance, announcements regarding regulatory changes or technological advancements can lead to rapid price movements that traders need to be prepared for. Moreover, adaptability is key in responding to changing market conditions. The cryptocurrency landscape is characterized by rapid innovation and shifting investor sentiment; thus, strategies that worked yesterday may not be effective today.

Traders should regularly review their strategies and be willing to adjust their approaches based on new information or changing market dynamics. This could involve altering entry and exit criteria based on recent price action or incorporating new technical indicators that better reflect current market conditions. By remaining flexible and responsive to market changes, traders can enhance their chances of success in an unpredictable environment.

Embracing Discipline and Patience

Discipline and patience are two virtues that every successful day trader must cultivate. The allure of quick profits can lead many traders to deviate from their established strategies or make impulsive decisions based on fleeting emotions. However, maintaining discipline involves adhering strictly to predefined trading rules and resisting the temptation to chase after every market movement.

For example, if a trader has set specific criteria for entering trades based on technical indicators but finds themselves entering positions based on gut feelings or FOMO, they risk undermining their long-term success. Patience is equally important in day trading; it allows traders to wait for optimal setups rather than forcing trades in unfavorable conditions. The best opportunities often arise after periods of consolidation or when significant news events unfold that create clear trends.

By exercising patience and waiting for these moments rather than rushing into trades out of boredom or anxiety, traders can improve their overall performance. Successful day trading requires not only skill but also the ability to remain calm under pressure and stick to one’s plan even when faced with market volatility.

Evaluating Your Day Trading Performance

Regularly evaluating trading performance is crucial for continuous improvement in day trading practices. Traders should maintain detailed records of their trades, including entry and exit points, position sizes, profit or loss outcomes, and any relevant notes about market conditions at the time of each trade. This data serves as a valuable resource for identifying patterns in trading behavior—both positive and negative—and allows traders to assess what strategies are working effectively.

In addition to tracking individual trades, evaluating overall performance metrics such as win rate (the percentage of profitable trades) and risk-reward ratio (the average profit per trade compared to average loss) provides insights into trading effectiveness. For instance, a trader with a win rate of 60% but an average loss significantly larger than their average gain may need to reassess their risk management strategies or entry criteria. By conducting thorough evaluations regularly—whether weekly or monthly—traders can refine their strategies based on empirical evidence rather than relying solely on intuition or anecdotal experiences.

This analytical approach fosters growth and development as traders strive for greater consistency and profitability in their day trading endeavors.