The advent of artificial intelligence (AI) and automation has revolutionized various sectors, and online trading is no exception. In recent years, the integration of these technologies has transformed how traders operate, making the process more efficient, data-driven, and accessible. AI algorithms can analyze vast amounts of market data in real-time, identifying patterns and trends that […]

Understanding Regulatory Changes Affecting Online Trading

The landscape of online trading has undergone significant transformations over the past few decades, driven largely by technological advancements and the increasing accessibility of financial markets. As more individuals engage in trading activities, the need for regulatory oversight has become paramount. Regulatory changes are designed to protect investors, ensure fair market practices, and maintain the […]

How Mobile Apps Are Changing the Online Trading Experience

In recent years, the financial landscape has undergone a significant transformation, largely driven by technological advancements. Among these innovations, mobile trading apps have emerged as a pivotal tool for investors and traders alike. These applications allow users to engage in trading activities directly from their smartphones or tablets, providing unprecedented access to financial markets. The […]

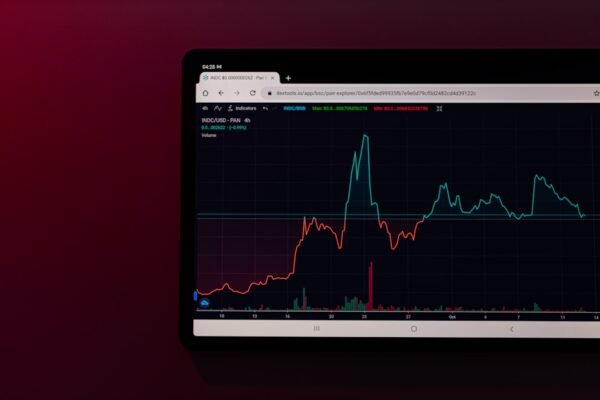

The Impact of Algorithmic Trading on Online Markets

Algorithmic trading has emerged as a transformative force in the financial markets, revolutionizing the way trades are executed and strategies are implemented. At its core, algorithmic trading involves the use of computer algorithms to automate the process of buying and selling securities. This technology-driven approach allows traders to execute orders at speeds and frequencies that […]

Risk Management Techniques for Online Traders

Online trading has revolutionized the way individuals and institutions engage with financial markets. With the advent of technology, trading has become more accessible than ever, allowing anyone with an internet connection to buy and sell assets ranging from stocks and bonds to cryptocurrencies and commodities. The rise of online trading platforms has democratized access to […]

Cryptocurrency Trading Platforms to Watch in 2025

Cryptocurrency trading platforms serve as the backbone of the digital asset economy, providing users with the necessary infrastructure to buy, sell, and trade various cryptocurrencies. These platforms have evolved significantly since the inception of Bitcoin in 2009, transitioning from rudimentary exchanges to sophisticated ecosystems that cater to millions of users worldwide. The rise of these […]

The Rise of Social Trading: Copying Experts in Real Time

Social trading has undergone a remarkable transformation since its inception, evolving from rudimentary online forums to sophisticated platforms that integrate social networking with trading functionalities. The concept can be traced back to the early 2000s when traders began sharing insights and strategies on online forums and chat rooms. These early forms of social trading were […]

Top Online Trading Tools for Retail Investors in 2025

The evolution of technology has significantly transformed the landscape of financial markets, making online trading more accessible than ever before. With the advent of sophisticated online trading tools, both novice and experienced investors can navigate the complexities of the market with greater ease and efficiency. These tools encompass a wide range of functionalities, from automated […]

How AI Is Transforming Online Trading Strategies

The integration of artificial intelligence (AI) into online trading has revolutionized the financial landscape, transforming how traders and investors approach the markets. AI technologies, characterized by their ability to analyze vast amounts of data and learn from patterns, have become indispensable tools for both institutional and retail traders. The rapid advancement of machine learning algorithms […]

The Future of Online Trading Platforms in 2025

The evolution of online trading platforms has revolutionized the way individuals and institutions engage with financial markets. In the past, trading was largely confined to the realm of brokers and financial institutions, where transactions were executed through cumbersome processes that often involved significant fees and delays. However, the advent of the internet has democratized access […]