The emergence of artificial intelligence (AI) has significantly transformed various sectors, and online trading is no exception. Over the past decade, the proliferation of AI trading bots has revolutionized how traders engage with financial markets. These automated systems leverage complex algorithms to analyze vast amounts of data, execute trades, and manage portfolios with minimal human intervention.

The rise of AI trading bots can be attributed to several factors, including advancements in technology, increased access to financial markets, and the growing demand for efficient trading solutions. As technology has evolved, so too have the capabilities of AI trading bots. Initially, these bots were relatively simple, relying on basic algorithms to execute trades based on predefined criteria.

However, as machine learning and data analytics have advanced, modern AI trading bots can now process real-time market data, identify patterns, and adapt their strategies accordingly. This evolution has made them increasingly popular among both retail and institutional traders, who seek to capitalize on market opportunities while minimizing emotional biases that can often cloud judgment.

How AI Trading Bots Work

Data Analysis and Real-Time Monitoring

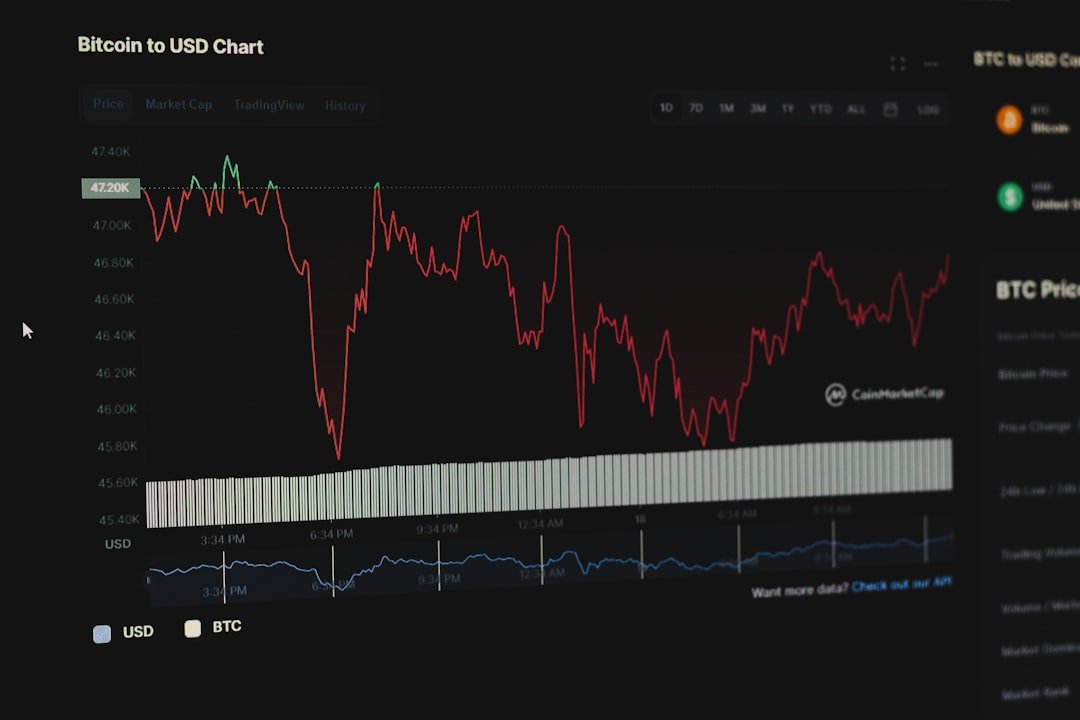

AI trading bots operate by utilizing sophisticated algorithms that analyze market data and execute trades based on predefined strategies. At their core, these bots rely on a combination of historical data analysis and real-time market monitoring to make informed decisions. They can process vast amounts of information in a fraction of a second, allowing them to identify trends and execute trades much faster than a human trader could.

Data Gathering and Pattern Identification

The functionality of AI trading bots can be broken down into several key components. First, they gather data from various sources, including price movements, trading volumes, and even news articles that may impact market sentiment. This data is then processed using machine learning techniques to identify patterns and correlations that may not be immediately apparent to human traders.

Automated Trade Execution

Once a trading opportunity is identified, the bot executes the trade automatically, often using algorithms that optimize entry and exit points to maximize profitability.

Advantages of Using AI Trading Bots

One of the primary advantages of using AI trading bots is their ability to operate 24/7 without fatigue or emotional bias. Unlike human traders who may experience stress or anxiety during volatile market conditions, AI trading bots remain unaffected by emotions, allowing them to make rational decisions based solely on data. This objectivity can lead to more consistent trading performance over time.

Additionally, AI trading bots can analyze vast amounts of data at speeds unattainable by human traders. This capability enables them to identify trends and opportunities in real-time, allowing for quicker execution of trades. Furthermore, many bots can backtest their strategies using historical data to refine their algorithms before deploying them in live markets.

This iterative process helps improve their performance and adapt to changing market conditions.

The Role of Machine Learning in AI Trading Bots

Machine learning plays a pivotal role in the functionality of AI trading bots. By employing algorithms that can learn from historical data, these bots continuously improve their trading strategies over time. Machine learning models can identify complex patterns in data that traditional statistical methods may overlook, enabling more accurate predictions about future price movements.

For instance, reinforcement learning—a subset of machine learning—allows trading bots to learn from their past actions by receiving feedback based on the outcomes of their trades. This feedback loop enables the bot to adjust its strategies dynamically, optimizing its approach based on what has proven successful in the past. As a result, machine learning enhances the adaptability and effectiveness of AI trading bots in an ever-evolving market landscape.

Risks and Challenges of Using AI Trading Bots

Despite their numerous advantages, AI trading bots are not without risks and challenges. One significant concern is the potential for overfitting, where a bot becomes too tailored to historical data and fails to perform well in live markets due to changing conditions. This phenomenon can lead to significant losses if traders rely solely on backtested results without considering current market dynamics.

Moreover, the reliance on algorithms raises questions about transparency and accountability. Many traders may not fully understand how a particular bot makes its decisions, leading to a lack of trust in its performance. Additionally, technical issues such as software bugs or connectivity problems can disrupt trading activities and result in unexpected losses.

Therefore, it is crucial for traders to remain vigilant and maintain a level of oversight when using AI trading bots.

The Impact of AI Trading Bots on Market Efficiency

Enhancing Market Efficiency

AI trading bots have significantly contributed to market efficiency by increasing liquidity and reducing bid-ask spreads. Their rapid trade execution capabilities have created a more dynamic market environment, where prices accurately reflect available information. By continuously analyzing data and executing trades based on real-time insights, these bots ensure that prices adjust quickly to new information.

Raising Concerns about Market Manipulation

However, the rise of AI trading bots has also raised concerns about market manipulation and flash crashes. High-frequency trading strategies employed by some bots can lead to sudden price fluctuations that may not reflect underlying fundamentals. During periods of extreme volatility, the rapid execution of trades by multiple bots can exacerbate price movements, leading to significant market disruptions.

The Need for Regulatory Action

While AI trading bots enhance efficiency in many ways, they also introduce complexities that regulators must address. It is essential for regulators to find a balance between allowing AI trading bots to operate and preventing potential market manipulation and disruptions.

Regulation and Ethics of AI Trading Bots

The increasing prevalence of AI trading bots has prompted discussions around regulation and ethical considerations within the financial markets. Regulatory bodies are tasked with ensuring fair practices while fostering innovation in technology-driven trading environments. However, the rapid pace of technological advancement often outstrips regulatory frameworks, creating challenges for oversight.

One ethical concern revolves around transparency in algorithmic trading practices. Traders using AI bots may not fully disclose their strategies or the underlying algorithms driving their decisions. This lack of transparency can lead to an uneven playing field where some traders possess an unfair advantage over others.

Additionally, issues related to data privacy and security arise as these bots often require access to sensitive information for optimal performance. Striking a balance between innovation and regulation is essential for maintaining market integrity while allowing for technological advancements.

When comparing AI trading bots with human traders, several key differences emerge that highlight the strengths and weaknesses of each approach. Human traders bring intuition, experience, and emotional intelligence to their decision-making processes—qualities that can be invaluable in navigating complex market dynamics. They can assess qualitative factors such as geopolitical events or changes in economic policy that may not be easily quantifiable.

Conversely, AI trading bots excel in processing large datasets quickly and executing trades without emotional interference. They can analyze historical trends and adapt their strategies based on real-time data far more efficiently than human traders. However, this reliance on algorithms means that they may struggle with unforeseen events or anomalies that deviate from established patterns.

Ultimately, the choice between using an AI trading bot or relying on human intuition often depends on individual preferences and risk tolerance.

The Future of AI Trading Bots in Online Trading

The future of AI trading bots appears promising as advancements in technology continue to reshape the financial landscape. As machine learning algorithms become more sophisticated and capable of processing increasingly complex datasets, we can expect even greater improvements in the performance of these automated systems. Furthermore, the integration of natural language processing (NLP) could enable bots to analyze news articles and social media sentiment more effectively, providing additional insights for decision-making.

Moreover, as regulatory frameworks evolve to accommodate technological advancements, we may see increased adoption of AI trading bots across various segments of the market. Retail investors are likely to benefit from user-friendly platforms that offer access to advanced trading strategies previously reserved for institutional players. As competition among bot developers intensifies, we can anticipate innovations that enhance transparency and user control over automated trading processes.

Tips for Choosing and Using AI Trading Bots

When selecting an AI trading bot, several factors should be considered to ensure optimal performance and alignment with individual trading goals. First and foremost, it is essential to evaluate the bot’s track record by examining its historical performance metrics and user reviews. A reputable bot should provide transparent information about its strategies and risk management practices.

Additionally, traders should consider the level of customization offered by the bot. Some platforms allow users to tailor strategies based on their risk tolerance and investment objectives, while others may operate on a more rigid framework. It is also crucial to assess the bot’s compatibility with various exchanges and asset classes to ensure it meets specific trading needs.

Once a bot is selected, proper usage involves continuous monitoring and adjustment based on market conditions. Traders should remain engaged with their automated systems rather than adopting a “set it and forget it” mentality. Regularly reviewing performance metrics and making necessary adjustments will help optimize results over time.

Case Studies: Successful Implementation of AI Trading Bots in Online Trading

Several case studies illustrate the successful implementation of AI trading bots within online trading environments. One notable example is Renaissance Technologies’ Medallion Fund, which employs sophisticated quantitative models driven by machine learning algorithms to achieve exceptional returns consistently. The fund’s success is attributed to its ability to analyze vast datasets and identify profitable trading opportunities across various asset classes.

Another example is the use of AI trading bots by retail investors through platforms like eToro or ZuluTrade. These platforms allow users to copy successful traders’ strategies or utilize automated systems that adapt based on real-time market conditions. Many users have reported significant gains by leveraging these technologies while benefiting from community insights and shared knowledge.

These case studies highlight how both institutional players and retail investors can harness the power of AI trading bots to enhance their trading strategies and achieve better outcomes in increasingly competitive markets.

FAQs

What are AI trading bots?

AI trading bots are computer programs that use artificial intelligence and machine learning algorithms to analyze market data, make trading decisions, and execute trades on behalf of investors. These bots can operate in various financial markets, including stocks, forex, and cryptocurrencies.

How do AI trading bots work?

AI trading bots work by analyzing large amounts of market data, such as price movements, trading volume, and news events, to identify trading opportunities. They can also learn from past trading data to improve their decision-making process. Once a trading opportunity is identified, the bot can automatically execute trades based on predefined parameters set by the user.

What are the benefits of using AI trading bots?

Some of the benefits of using AI trading bots include the ability to analyze and process large amounts of data quickly, the potential to make more informed trading decisions, and the ability to execute trades automatically without human intervention. Additionally, AI trading bots can operate 24/7, allowing for continuous monitoring of the markets.

What are the risks of using AI trading bots?

Some of the risks of using AI trading bots include the potential for technical glitches or malfunctions that could lead to unexpected trading losses. Additionally, AI trading bots may not always accurately predict market movements, leading to potential financial losses. It’s important for investors to carefully monitor and review the performance of AI trading bots to mitigate these risks.

How are AI trading bots changing online trading?

AI trading bots are changing online trading by providing investors with access to advanced trading algorithms and technology that can analyze market data and execute trades more efficiently than traditional methods. This can potentially lead to improved trading outcomes and increased automation in the trading process.