In the fast-paced world of trading, the ability to access real-time market insights is paramount. Traders operate in an environment where every second counts, and the difference between a profitable trade and a significant loss can hinge on the timeliness of information. Real-time market insights provide traders with immediate data regarding price movements, trading volumes, and market sentiment, enabling them to make informed decisions quickly.

This immediacy is crucial, especially in volatile markets where conditions can change rapidly. For instance, during significant economic announcements or geopolitical events, market dynamics can shift dramatically within minutes, underscoring the necessity for traders to have access to up-to-the-minute information. Moreover, real-time insights allow traders to identify trends and patterns as they emerge.

By analyzing live data feeds, traders can spot opportunities that may not be visible through traditional analysis methods. This capability is particularly beneficial in high-frequency trading environments, where algorithms execute trades based on real-time data analysis. The ability to react swiftly to market changes can lead to enhanced profitability and reduced risk exposure.

As such, the integration of real-time market insights into trading strategies is not merely advantageous; it is essential for success in today’s competitive trading landscape.

Understanding AI Tools for Trading

Artificial Intelligence (AI) tools have revolutionized the trading landscape by providing sophisticated analytical capabilities that far exceed traditional methods. These tools leverage machine learning algorithms and data analytics to process vast amounts of market data, identifying patterns and trends that human traders might overlook. AI tools can analyze historical data, current market conditions, and even social media sentiment to generate predictive models that inform trading decisions.

This advanced level of analysis allows traders to make more informed choices based on comprehensive data rather than relying solely on intuition or experience. Furthermore, AI tools can adapt to changing market conditions in real time. Unlike static models that may become outdated as market dynamics shift, AI systems continuously learn from new data inputs, refining their algorithms to improve accuracy over time.

This adaptability is particularly valuable in markets characterized by rapid fluctuations and unpredictable events. For example, AI-driven trading platforms can adjust their strategies based on emerging trends or sudden market shocks, providing traders with a significant edge in their decision-making processes.

How AI Tools Provide Real-Time Market Insights

AI tools provide real-time market insights through a combination of data aggregation, analysis, and visualization techniques. These tools gather data from multiple sources, including stock exchanges, financial news outlets, social media platforms, and economic indicators. By consolidating this information into a single platform, AI tools enable traders to access a comprehensive view of the market landscape at any given moment.

The aggregation process is often powered by natural language processing (NLP) algorithms that can interpret unstructured data from news articles or social media posts, translating qualitative information into quantitative insights. Once the data is aggregated, AI tools employ advanced analytical techniques to identify trends and anomalies. Machine learning algorithms can detect patterns in historical price movements and correlate them with current market conditions to forecast future price actions.

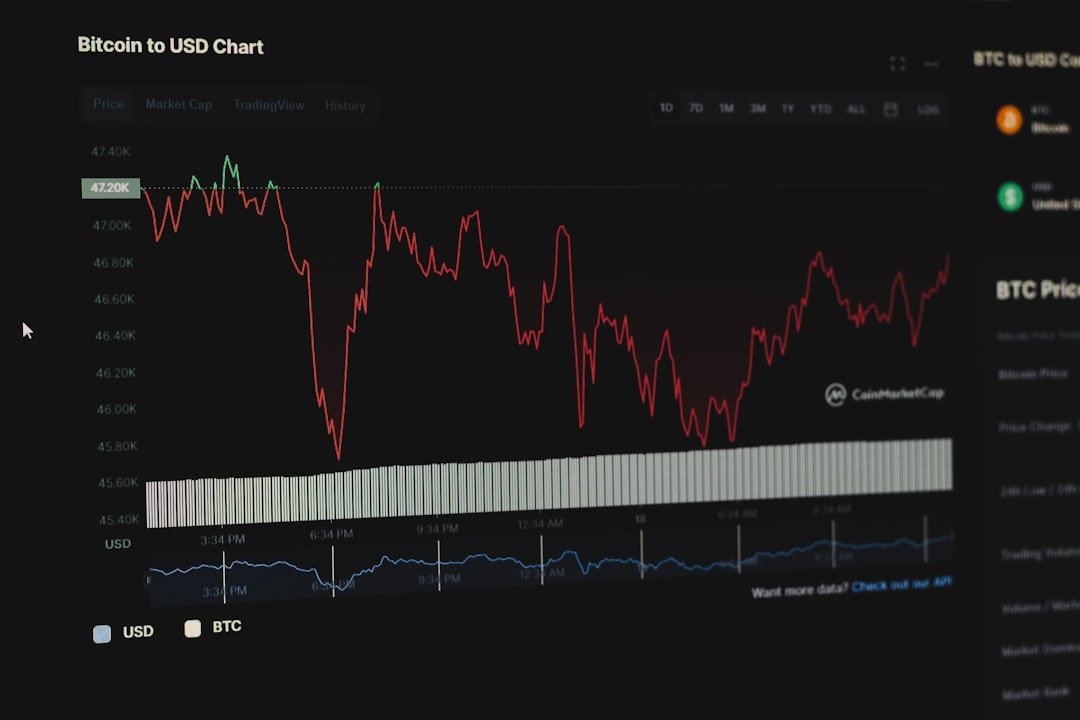

For instance, an AI tool might analyze past performance during similar economic conditions to predict how a stock will react to an upcoming earnings report. Additionally, these tools often feature real-time dashboards that visualize key metrics such as price changes, volume spikes, and sentiment analysis, allowing traders to quickly assess the market’s pulse and make timely decisions.

Benefits of Using AI Tools for Smarter Trading

The integration of AI tools into trading strategies offers numerous benefits that enhance decision-making processes and improve overall trading performance. One of the most significant advantages is the ability to process vast amounts of data at unprecedented speeds. Human traders are limited by their capacity to analyze information; however, AI tools can sift through terabytes of data in seconds, identifying actionable insights that would take a human trader hours or even days to uncover.

This speed not only increases efficiency but also allows traders to capitalize on fleeting opportunities in the market. Another key benefit is the reduction of emotional bias in trading decisions. Human emotions such as fear and greed can cloud judgment and lead to irrational trading behaviors.

AI tools operate based on data-driven algorithms that eliminate emotional influences from the decision-making process. By relying on objective analysis rather than subjective feelings, traders can adhere more closely to their strategies and avoid costly mistakes driven by emotional responses. This disciplined approach fosters a more systematic trading environment where decisions are made based on empirical evidence rather than gut feelings.

Challenges and Limitations of AI Tools in Trading

Despite the numerous advantages offered by AI tools in trading, there are also challenges and limitations that traders must consider. One significant challenge is the reliance on historical data for predictive modeling. While AI algorithms can analyze past performance to forecast future trends, they may struggle in unprecedented market conditions or during black swan events—rare occurrences that are difficult to predict based on historical data alone.

For example, the COVID-19 pandemic created market conditions that were unlike anything seen before, leading many AI models to produce inaccurate predictions. Additionally, the complexity of AI algorithms can pose challenges in terms of transparency and interpretability. Many advanced machine learning models operate as “black boxes,” making it difficult for traders to understand how decisions are made or which factors are influencing predictions.

This lack of transparency can lead to mistrust in the system and may deter some traders from fully embracing AI tools. Furthermore, over-reliance on these systems without a solid understanding of their underlying mechanics can result in significant risks if the models fail to perform as expected.

Implementing AI Tools in Trading Strategies

Implementing AI tools into trading strategies requires careful planning and consideration of various factors. First and foremost, traders must define their objectives clearly—whether they aim for short-term gains through day trading or long-term investments through swing trading strategies. Understanding these goals will help determine which AI tools are most suitable for their needs.

For instance, high-frequency traders may benefit from algorithmic trading platforms that execute trades within milliseconds based on real-time data analysis. Once objectives are established, traders should evaluate different AI tools available in the market based on their features, ease of use, and compatibility with existing systems. Many platforms offer customizable solutions that allow traders to tailor algorithms according to their specific strategies.

Additionally, it is essential to conduct thorough testing before fully integrating an AI tool into a trading strategy. Backtesting against historical data can help assess the effectiveness of the tool and identify potential weaknesses or areas for improvement.

Choosing the Right AI Tool for Your Trading Needs

Selecting the right AI tool for trading involves a comprehensive evaluation of various options available in the marketplace. Traders should consider factors such as functionality, user interface, integration capabilities with existing platforms, and cost-effectiveness when making their choice. Some tools may specialize in specific asset classes—such as stocks, forex, or cryptocurrencies—while others offer broader capabilities across multiple markets.

Understanding one’s trading style and preferences will guide this selection process. Moreover, it is crucial to assess the level of support and resources provided by the tool’s developers. A robust support system can significantly enhance the user experience by offering training materials, customer service assistance, and regular updates to improve functionality over time.

Additionally, reading user reviews and testimonials can provide valuable insights into how well a particular tool performs in real-world trading scenarios.

Real-Life Examples of AI Tools in Action

Several prominent examples illustrate how AI tools have been successfully integrated into trading practices across various markets. One notable case is Renaissance Technologies, a quantitative hedge fund known for its use of sophisticated algorithms and machine learning techniques to drive its investment strategies. The firm’s Medallion Fund has consistently outperformed traditional investment vehicles by leveraging vast datasets and advanced analytics to identify profitable trades.

Another example is Trade Ideas, an AI-powered platform that provides real-time stock scanning and alerts based on user-defined criteria. The platform utilizes machine learning algorithms to analyze historical price movements and generate trade ideas tailored to individual trader preferences. Users have reported significant improvements in their trading performance after incorporating Trade Ideas into their strategies.

The Future of AI Tools in Trading

The future of AI tools in trading appears promising as advancements in technology continue to evolve at a rapid pace. As machine learning algorithms become more sophisticated and capable of processing larger datasets with greater accuracy, traders can expect even more refined predictive models that enhance decision-making processes. Additionally, developments in natural language processing will enable AI systems to interpret qualitative data from news articles or social media more effectively, providing deeper insights into market sentiment.

Furthermore, as regulatory frameworks around AI in finance continue to develop, there will likely be increased transparency and accountability regarding how these tools operate. This evolution could foster greater trust among traders who may have previously been hesitant to adopt AI technologies due to concerns about reliability or ethical considerations.

Integrating AI Tools with Traditional Trading Methods

Integrating AI tools with traditional trading methods presents an opportunity for traders to enhance their strategies while maintaining a balanced approach. Many successful traders combine their expertise with AI-driven insights to create hybrid strategies that leverage both human intuition and machine intelligence. For instance, a trader might use an AI tool for real-time market analysis while relying on their experience to make final decisions based on qualitative factors such as news events or economic indicators.

This integration allows traders to benefit from the strengths of both approaches—utilizing AI’s speed and analytical capabilities while retaining human judgment’s nuanced understanding of market dynamics. By adopting a collaborative mindset between technology and traditional methods, traders can create more robust strategies that adapt effectively to changing market conditions.

Tips for Maximizing the Potential of AI Tools in Trading

To maximize the potential of AI tools in trading, several best practices should be considered. First and foremost, continuous education is vital; traders should stay informed about advancements in AI technology and how they can be applied within their strategies. Engaging with online courses or attending industry conferences can provide valuable insights into emerging trends and techniques.

Additionally, maintaining a disciplined approach is crucial when using AI tools. Traders should establish clear rules for when to enter or exit trades based on signals generated by their chosen platform while avoiding impulsive decisions driven by short-term fluctuations or emotional responses. Regularly reviewing performance metrics will also help identify areas for improvement and refine strategies over time.

By embracing these practices alongside effective use of AI tools, traders can enhance their decision-making processes and ultimately achieve greater success in their trading endeavors.

FAQs

What are real-time market insights?

Real-time market insights refer to the up-to-the-minute information and analysis of market trends, news, and data that can help traders make informed decisions about buying and selling assets.

What are AI tools for trading?

AI tools for trading are software applications that use artificial intelligence and machine learning algorithms to analyze market data, identify patterns, and make predictions about future market movements.

How do AI tools provide smarter trading insights?

AI tools provide smarter trading insights by processing large volumes of data at high speeds, identifying complex patterns that human traders may miss, and making data-driven predictions about market movements.

What are the benefits of using AI tools for trading?

The benefits of using AI tools for trading include improved decision-making based on data-driven insights, faster analysis of market trends, reduced human error, and the ability to identify trading opportunities in real time.

Are AI tools for trading accessible to individual traders?

Yes, many AI tools for trading are accessible to individual traders through online platforms and trading software. Some tools may require a subscription or payment for access.